January: Tourism in Germany Makes Record Gains

January: Tourism in Germany Makes Record Gains

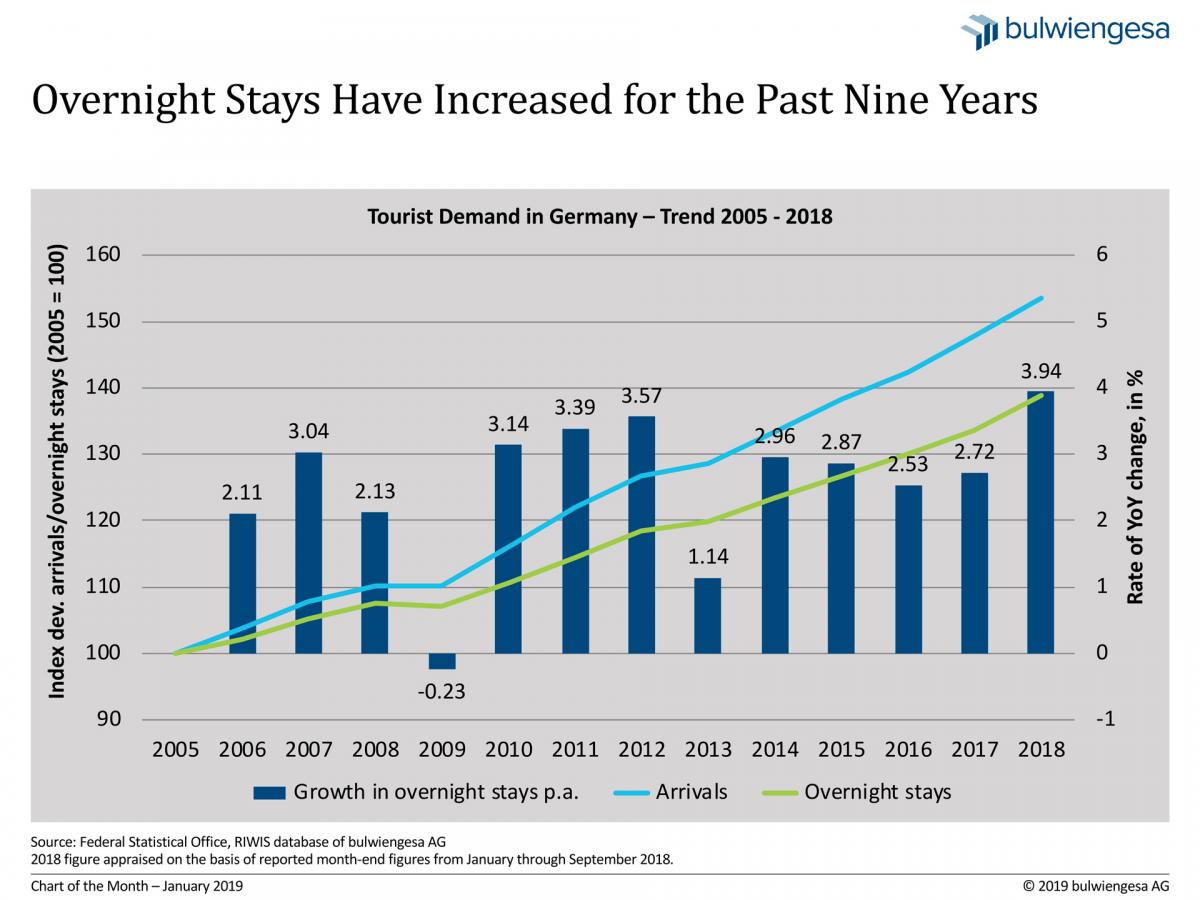

Tourism in Germany is prospering. For nine years running, arrivals and overnight stays have been growing in number. The primary reason is strong domestic demand. By contrast, international tourism still has room for development in many cities.

According to provisional projections, the number of arrivals reported by the hospitality industry rose by 3.8 % to around 185.1 million in 2018, and the number of overnight stays by 3.9 % to around 477.6 million. These growth rates present a new record high and document the appeal that Germany has for guests from inside and outside the country.

This positive development is remarkable but not unique in Europe. Germany’s neighbours also benefit from the global growth in tourism. In fact, overnight stays in Denmark, Poland and the Netherlands increased even faster in number than they did here over the past years. But judging by absolute tourist figures, Germany is far ahead of its neighbours.

In Many Cities, International Tourism Could be Expanded

The high number of overnight stays in Germany is due to strong domestic demand. Germany is the leading travel destination for her people, well ahead of Spain, Italy or France. The incoming tourism, by contrast, shows room for development. Only one in five visitors to Germany hails from abroad. This is a low percentage compared to other main tourist destinations in Europe. For instance, the foreign share in the number of overnight-stays is roughly one third in France, around half in Italy and about two thirds each in Spain and Austria.

Within Germany, the incoming tourism share varies considerably from one place to the next. Southern Germany is generally more popular among foreign visitors than the north, while the west is favoured over the east. The ratio of domestic to foreign visitors also varies significantly among the major cities. The overnight share of foreign guests in Hamburg, for example, is far lower than it is in Berlin, Frankfurt or Munich where internationally known features like the Oktoberfest or major trade fairs positively influence demand from abroad.

Germany’s metropolises are steadily gaining in significance as travel destinations. German mid-sized and major cities with populations of more than 100,000 already account for nearly one in three overnight stays, and the 14 German cities with more than 500,000 residents claim two thirds of this total.

At the same time, German holiday regions report a growing number of overnight stays. The gains have been particularly brisk on the seaboard along North Sea and Baltic Sea, with provisional figures projecting an increase in overnight stays by almost 20 % in 2018 alone. But the hill country of the Harz, Sauerland or Allgäu regions is also becoming more and more popular.

Keen Demand for Chain and Brand Hotels

In many cities, demand is outpacing supply: The bed occupancy rate in German hospitality in general has climbed by around eight percentage points to 46.3 % over the past ten years; between January and October 2018, the occupancy rate averaged 63.6 %. Germany’s chain hotel industry has reported rising room occupancy rates and increasing average room rates.

The branded hospitality sector is at an advantage here. It has spent the past years continually optimising its processes, not least by introducing systems for customer relations management (CRM), revenue management or for reservations and back office management. The upgrades are reflected in the revenue figures of many hotel chains. On the downside, the process has left many mid-market businesses behind that lack the financial wherewithal for digitisation, modernisation and marketing. Indeed, it has driven many small-scale operations out of business.

Hotel chains are expanding at a very brisk pace. Ending a long period during which the chain hotel industry focused its expansion efforts on major German cities, hotel chains have lately become interested in mid-size German cities that lack up-to-date and highly productive offers. In addition, Germany holiday regions are increasingly moving into the focus of operators, investors and developers because of their robust growth opportunities.

Contact person: Dierk Freitag, Head of Division for the Leisure and Hospitality Market at bulwiengesa, freitag [at] bulwiengesa.de