May: “Unternehmensimmobilien” – Many Occupiers Seek Short Lease Terms

May: “Unternehmensimmobilien” – Many Occupiers Seek Short Lease Terms

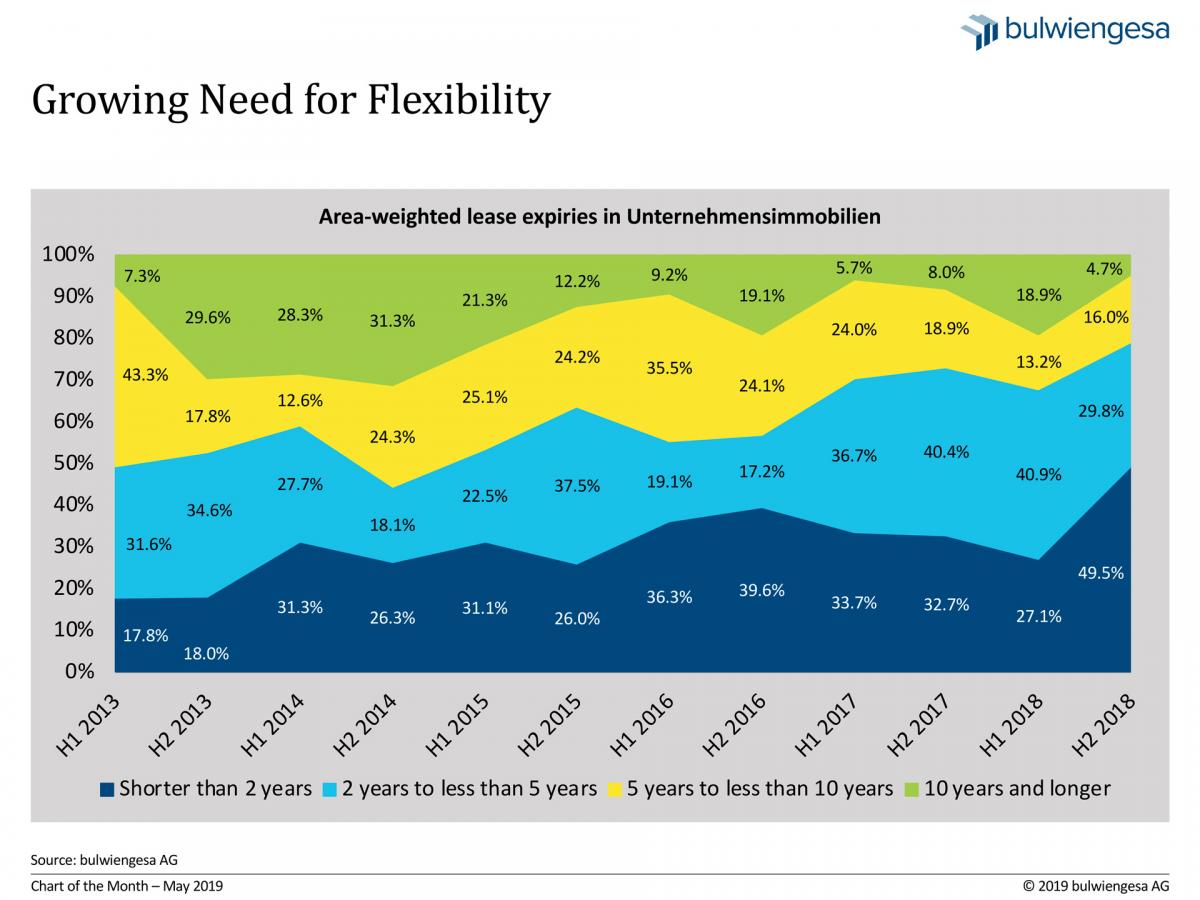

Fewer German companies than ever are willing to tie themselves long-term to a given property. The latest market report by Initiative Unternehmensimmobilien reveals: Lease terms have drastically shortened in recent years. Just five out of 100 occupiers rent for periods of ten years or more.

As the chart shows: There has been a conspicuous decline in long lease terms in recent years. Inversely, the take-up during the past half-year suggests a considerable increase in the number of leases signed for terms of less than one year. Lease agreements of this category now account for around 36 % of the total, and thus exceed the long-term mean by more than 16 %. Together with rolling lease agreements with weekly or monthly terms, these agreements almost make up half of the total.

Moreover, medium lease terms of three to five years, which used to be preferred option, have lost in relevance. Rather, lease terms fell well short of the long-term mean. On balance, long-term leases over five years or more made up around 20 % of the demand for space. Uncertainty regarding the economic development going forward may be playing a role (factors including Brexit, trade rows and growing political uncertainty). Apparently, tenants appreciate flexibility – including in regard to contractual commitments – especially in increasingly uncertain times.

So, what does this trend imply for the landlords’ side? On the one hand, short-term leases represent a risk factor because they compromise the certainty of the cash flow over time: It remains to be seen whether or not a given property will find a new tenant two or three years hence. On the other hand, this presents precisely one of the fortes of German Unternehmensimmobilien, i.e. multi-use and multi-let commercial properties. Their mostly flexible floor plans engage a broad-based spectrum of occupiers. Especially in good locations, properties with a market-consistent quality of amenities are barely troubled by vacancies. Ultimately, short-term leases also present an opportunity for landlords to re-negotiate a given lease in regular intervals – whether it be in regard to the lease term or in regard to the rent level.

About INITIATIVE UNTERNEHMENSIMMOBILIEN

At the moment, INITIATIVE UNTERNEHMENSIMMOBILIEN is made up of ten member companies active on the German market for the multi-use, multi-let commercial real estate called “Unternehmensimmobilien”, these being Aurelis, BEOS, Corestate Capital Group, Cromwell Property Group, Frasers Property, Garbe Industrial Real Estate, Investa, SEGRO, Siemens and Sirius. Their common objective is to enhance the transparency of this market segment and thereby to facilitate access to the asset class. For this purpose, a reporting system was set up in collaboration with bulwiengesa whose purpose is to evaluate all of the transaction and letting data made available by initiative members. Investors and market analysts are regularly briefed about the sector’s trading volume and performance. This takes primarily the form of the Market Report published twice a year.

Note: For the Market Report #10, all previous market reports, and other information, click here.

Contact persons: Tobias Kassner, Head of Division Industrial and Logistics Real Estate at bulwiengesa, kassner [at] bulwiengesa.de and Patrik Völtz, Principal Investigator, voeltz [at] bulwiengesa.de