June: Commercial Investment Preferences Have Clearly Shifted

June: Commercial Investment Preferences Have Clearly Shifted

Office real estate is investors’ darling and has taken the place of retail real estate. That said, many investors, including more and more German institutional investors, have also warmed to logistics and operator real estate in recent years.

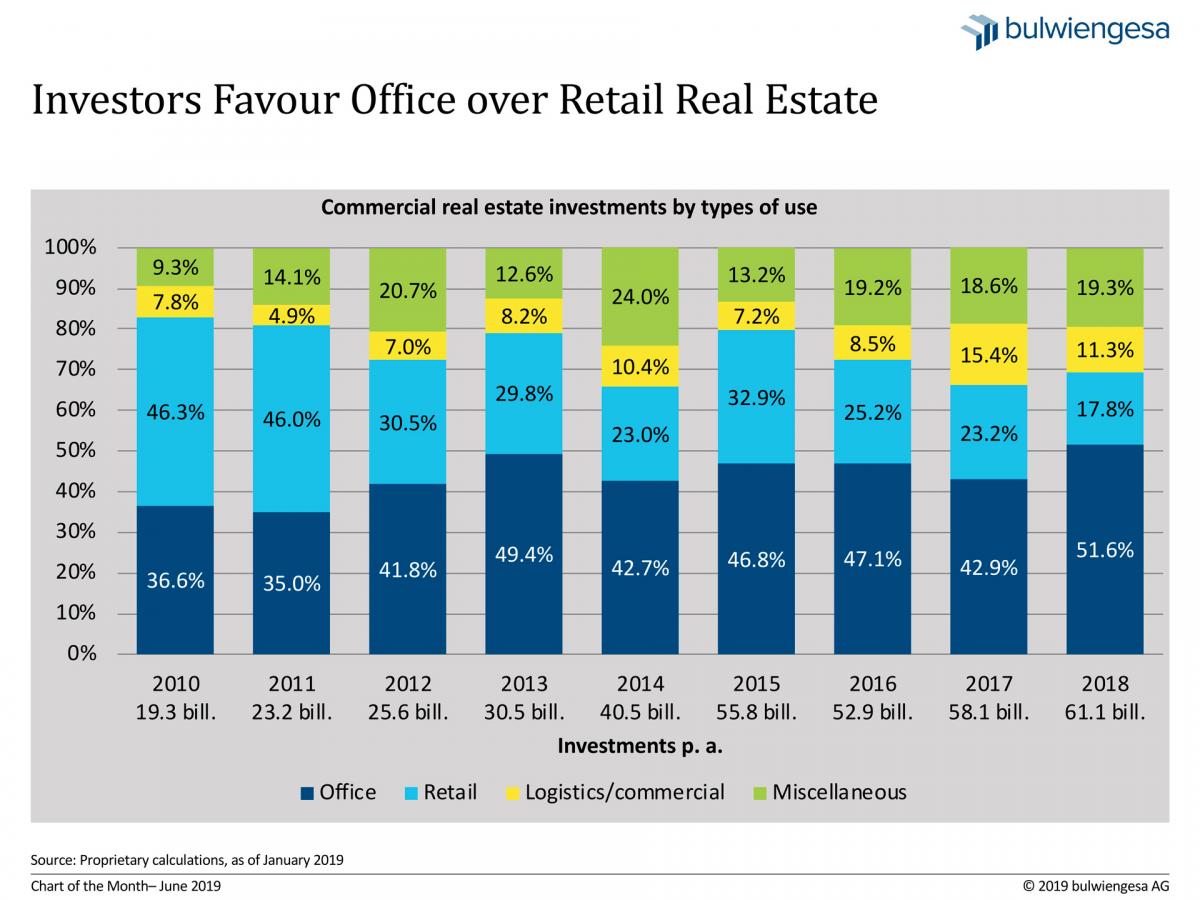

For years, there has been an enormous demand for commercial real estate investments in Germany. The annual volume of new investments in commercial real estate has tripled since the financial crisis, as illustrated by the chart below. Market evidence suggests, however, that we are now entering a plateau phase: Notwithstanding the keen demand in the current low interest rate environment, a significant further increase in transaction volume is not to be expected. There is simply not enough product on the market.

The chart highlights one aspect above all: In addition to the steady increase of the overall volume, the shares claimed by the various types of use have drastically shifted in recent years. Particularly conspicuous to note is that office real estate has taken the place of retail real estate as the most important asset class on the investment market. Moreover, logistics real estate and operator real estate such as hotels and care homes have gained in significance.

Moving Away from Retail Properties – Except for Certain Types

Many of the reasons why investors are pulling out of retail real estate are well known. For one thing, the growth potential of the brick-and-mortar retail business, especially of the segment serving the discretionary demand (fashion, electronics/appliances, etc.) is seen as being compromised by the growing competition in online retailing. This has caused prime rents of shopping centres but also of commercial building in high-street pitches of major cities to stagnate in recent years. At the same time, initial yield rates in Class A cities are already down to around 3 % anyway. The high price level, the absence of a rental upside and falling sales revenues or intensifying competition therefore count among the reasons for the diminished appeal of shopping centres and commercial buildings.

Very much sought after, by contrast, are retail warehouses and retail warehouse parks with mainly non-discretionary offers (groceries/drugs) in good locations. But the transaction total for this type of retail property rarely exceeds 30 million euros.

High Office Prices are Accepted

So, what about the coveted office real estate market? For years, construction activities have been unable to satisfy the fast-increasing demand. The result is that rents in virtually all major German cities have registered substantial upward growth in sync with a steadily contracting supply of floor space. What is more, the demand for office accommodation in the cities is expected to remain strong in the medium term, and this despite noticeably stepped-up construction activities in good locations intended to satisfy the pent-up demand. The situation arguably implies rental upside potential. And with a view to the intact growth prospects, investors are willing to accept the high price level for office assets.

High prices and the short supply in investment-grade properties in both the office segment and the retail segment have prompted investors since 2014/2015 to consider alternative real estate segments for their investments. Especially the demand group for logistics properties has expanded. This segment, in which only a handful of investors used to be active, mainly from Anglo-American countries, has increasingly attracted commitments by German institutional investors, including insurance companies, pension funds or open-ended property funds. This helps to explain why the yield compression for logistics real estate since 2016 has progressed at a much faster rate than that of the office segment, for example.

Contact person: Andreas Wiegner, project manager investment, wiegner [at] bulwiengesa.de