Dare to Invest in Class C Cities

Dare to Invest in Class C Cities

No matter how low yield rates for flats in Class A cities drop, investors keep being attracted to conurbations. Opting for B- and C-class cities instead seems to be the obvious choice. Objectively speaking, that is. Yet our latest survey for the d.i.i. Group checks whether these cities represent sensible alternatives in terms of their risk-return ratio and, if so, which ones would be best.

The baseline situation on the housing market of the major German cities has become ever more precarious in recent years: The much-discussed housing shortage continues to dominate the market action. Cumulatively, a total of 11.79 million households in the A-, B- and C-class cities is matched by only 11.19 million flats in residential and non-residential buildings. The imbalance is particularly conspicuous in Heidelberg, Freiburg im Breisgau, Karlsruhe and Hanover. Then again, there are no less than twelve A-, B- and C-Class cities with more flats than households, most notably Magdeburg, Erlangen, Wuppertal and Dortmund.

The drastically increased capital values of rental flats and condominiums as well as the scant availability of zoned land in the Class A cities have prompted property developers and investors to shift their focus increasingly to the so-called B- and C-class cities. Because they “only” play a regional and national role, they do not have the significance of Class A cities like Munich, Berlin or Frankfurt. Still, their standing on the national and regional level should not be underestimated, especially not if you consider that some of them are located in conurbations or close to important Class A cities. B- and C-class cities are particularly well positioned to exploit the demand pressure on the housing markets of Class A cities.

Their indicators, include demographics and job growth, rents and prices of flats as well as land prices for multi-unit dwellings, often develop in sync with those of the Class A cities, but their absolute price and rent levels tend to be well below those of the latter. At the same time, nearly all of these markets are characterised by a more or less conspicuous absence of housing construction activity and by very low vacancy rates. With this in mind, it makes sense that more and more investors are shifting their investment focus to B- and C-class cities. Although these second- and third-tier cities imply higher risks, these are offset by better yield prospects.

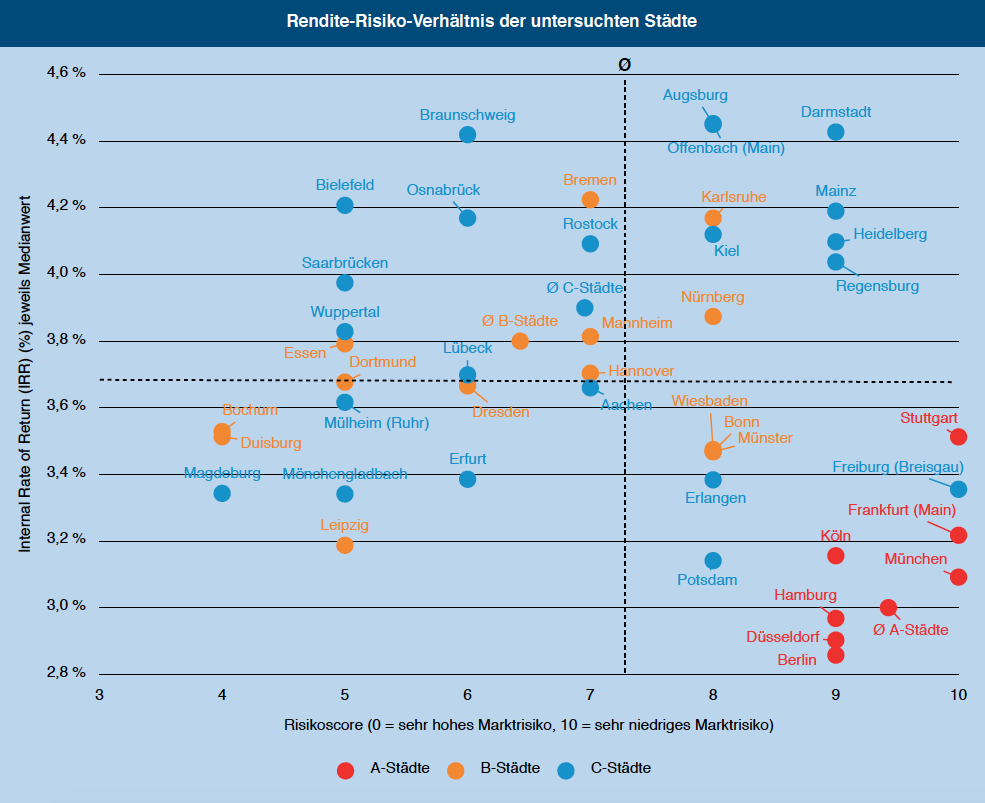

Within the framework of the survey, all of the seven Class A cities, 14 Class B cities and 22 Class C cities were analysed and checked in regard to returns and risks. It thus provides investors with a quick first overview of the housing markets. The combination of yield assessment via a scenario-based IRR calculation and risk assessment via a scoring on the district level delivers a fresh approximation.

Two things regarding the methodology: The return component, as part of the survey on the risk/return ratio for residential investments, was determined using a dynamic model whose methodology is anchored in the “5 % Survey” conducted by bulwiengesa since 2015. The model determines the probable interest (IRR = internal rate of return) of an investment in a residential property for an assumed holding period of ten years.

Threats: Class A Cities with the Lowest and Class B Cities with the Highest Market Risks

What does that mean specifically? The “Big Seven” or Class A cities emerged from the risk analysis with the best market risk scores, which means, of course, that their market risk is very low. Specifically, three of the four cities with the maximum overall score of 10 were Class A cities, namely Munich, Stuttgart and Frankfurt am Main. Fourth on the list of cities with lowest market risk comes Freiburg im Breisgau, which is a Class C city. The result comes as no surprise: Class A cities boast the greatest economic strength, offer extensive living and educational opportunities and benefit from steady population growth. So, Freiburg may seem unexpected at first glance. Yet in terms of investment risks, the city shows scores on a level with the Class A cities, especially in regard to the indicators rent, accessibility, employees with a degree, production overhang and flats per household; at an average of 3.4 %, even Freiburg’s yield rate ranks with the upper end of the Class A cities, which have the lowest yield prospects at an average of 3 %.

The highest market risks among the cities examined were identified in the Class C city of Magdeburg and in the Class B cities Bochum and Duisburg where the achievable passing rents are comparatively low. They also report comparatively inferior economic values because of high unemployment rates and low disposable incomes.

On the whole, Class B cities show the highest market risk, with Nuremberg, Karlsruhe, Wiesbaden, Münster and Bonn scoring highest whereas Bochum and Duisburg bring up the rear. Class C cities represents the category with the widest market risk spread. The city with the lowest risk is Freiburg, the riskiest one being Magdeburg. That said, more than half of all B- and C-class cities show a good to excellent market risk score.

Compared by geographic location, cities in southern Germany return the highest scores, making this part of the country with its sound parameters well-suited for risk-averse investors. The risk analysis also shows that the discrepancy between East- and West-German cities persists. For one thing, East German cities usually present higher market risks. Among the obvious exceptions are Berlin and Potsdam. It should be added that East German cities with elevated market risks imply opportunities for investors with value-add strategies.

Yields: Augsburg and Offenbach on Record with Highest Rate, Berlin with Lowest

The decisive factor for calculating rates of return is the projected rent growth above all. The Class C cities Augsburg and Offenbach am Main, for instance, combine above-average rent gains with the highest yield rates (4.5 % each). The highest yields among Class B cities were reported from Bremen and Karlsruhe (4.2 % each). Among the Class A cities, Stuttgart tops the yield ranking with 3.5 %. Here, too, the high yield rate coincides with a high rent growth forecast (2.3 %). The rent growth in the Class A cities averages 1.8 % only. This explains why the achievable yields are as low as 3.0 % in Hamburg and 2.9 % in both Berlin and Düsseldorf.

Class C cities show a wider yield spread, with the performance expectations ranging from 3.3 % to 4.8 % maximum. Investors are in any case well advised to focus on cities with sustainable demographics as key decision factor. Generally speaking, Class C cities promise the highest rates of return (3.9 %) while being closely trailed by Class B cities with 3.8 %. Conversely, the lowest return on investment is offered by Class A cities (3 % on average).

Note: The full-length survey (German) is available for download on the homepage of d.i.i.

Contact person: Felix Embacher, Head of Division for Master Planning and Special Housing Types at bulwiengesa, embacher [at] bulwiengesa.de