April: More Lucrative, Less Complicated – Property Developers Embrace Business Assets

April: More Lucrative, Less Complicated – Property Developers Embrace Business Assets

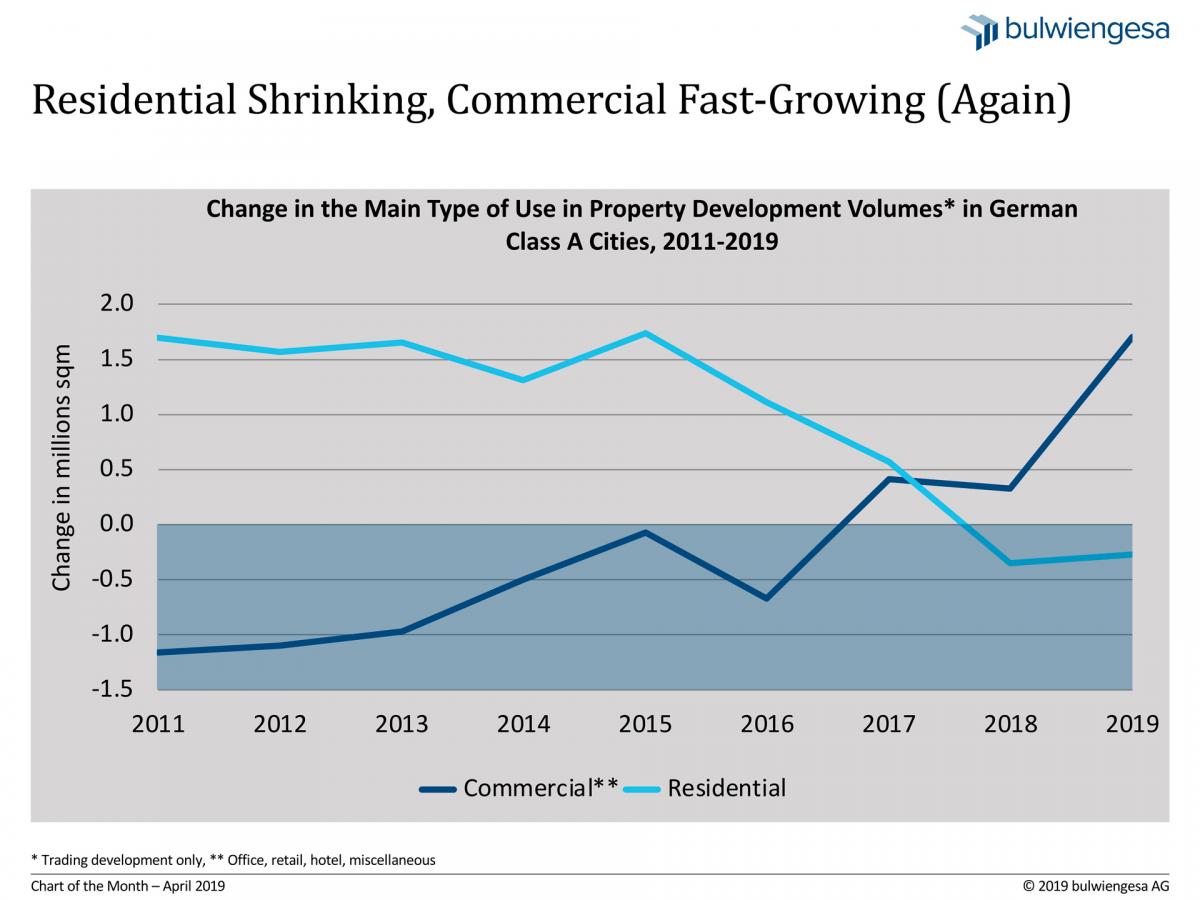

Things shifted in 2017. Commercial property completions outperformed residential ones for the first time that year. Today, even housing developers increasingly prefer to develop commercial premises, especially offices. If nothing else, this cushions the office vacancy situation that paralysed some markets.

Fewer restriction, slightly higher yield rates – these are the main reasons why commercial, and specifically office, property developments have become so popular lately (see also the Blog article of 22 March 2019). The latest chart, covering the 2019 Property Developer Survey, highlights these changes: The land used for commercial projects in Germany’s “Big Seven” cities has steadily increased since the 2017 survey year. Conversely, the dwelling floor area in residential property developments more or less ceased to grow in 2017 and actually started to decline in 2018. Both shifts in trend were the first of their kind to be registered since the start of the Property Developer Survey.

Fewer restriction, slightly higher yield rates – these are the main reasons why commercial, and specifically office, property developments have become so popular lately (see also the Blog article of 22 March 2019). The latest chart, covering the 2019 Property Developer Survey, highlights these changes: The land used for commercial projects in Germany’s “Big Seven” cities has steadily increased since the 2017 survey year. Conversely, the dwelling floor area in residential property developments more or less ceased to grow in 2017 and actually started to decline in 2018. Both shifts in trend were the first of their kind to be registered since the start of the Property Developer Survey.

After years of shrinking floor area totals, the office segment is registering an increase in floor area under development for the third year in a row – this time by a tidy 23 % or 1.3 million square metres. But the retail, hotel and logistics segments have also experienced growth. While all of the Class A cities are reporting increases in office space, the growth is much faster in some cities than in others, amounting to 32 % or 550,000 sqm in Berlin, for instance. The growth is driven mainly by accommodation still under development or in planning.

Of course, this trend does nothing to mitigate the housing shortage. But with the office construction boom in the Class A cities, trading developers are also responding to the vacancy level, which is very low in some of these cities. The lowest vacancy rate among the “Big Seven” was registered in Munich (1.6 %) and in Berlin (1.7 %), the highest in Düsseldorf (6.9 %) and in Frankfurt am Main (7.2 %). The noticeable increase in office accommodation is a piece of good news for the markets because it brings them urgently needed relief. For the next year or two, market players won’t have to worry about overcapacities yet, as it will take longer than that to satisfy the demand that built up over the past years. A number of companies are now finally able to move ahead with their plans to expand which they kept having to postpone because of the short supply in floor space.

Another interesting aspect is not even visible in the chart: You need to add the property developments by owner-occupiers whose volume has also been studied by the survey in recent years. In this context, one must distinguish between two types of developers: trader developers—meaning the classic developers who plan to sell their projects—and investor developers who intend to owner-occupy theirs. The absence of investment alternatives ensures that property developments for the own portfolio remain attractive both in the residential and the commercial segments. This explains why even the office, retail and hotel segments continued to register substantial growth.

About the Property Developer Survey

For the thirteenth time, bulwiengesa examined the property development markets in Germany’s “Big Seven” cities, these being Berlin, Cologne, Düsseldorf, Frankfurt am Main, Hamburg, Munich and Stuttgart. Using the basis of roughly 5,000 individual projects (thereof around 3,200 trading development projects, available as Excel list), bulwiengesa analysed the structure and volume of the property developer market and derived drilldown assessments for each city. The survey focuses on the use types office, residential, retail and hotel. It uses extensive project lists to provide a detailed market overview of the various players and their projects.

Note: The survey was published in early April, using charts to visualise the detailed findings on cities and segments. On our homepage, you will also find the order form for purchasing copies of the survey or of the city reports.

Contact person: Ellen Heinrich, project manager at bulwiengesa, heinrich [at] bulwiengesa.de