July: Municipalities Remain Cause for Concern

July: Municipalities Remain Cause for Concern

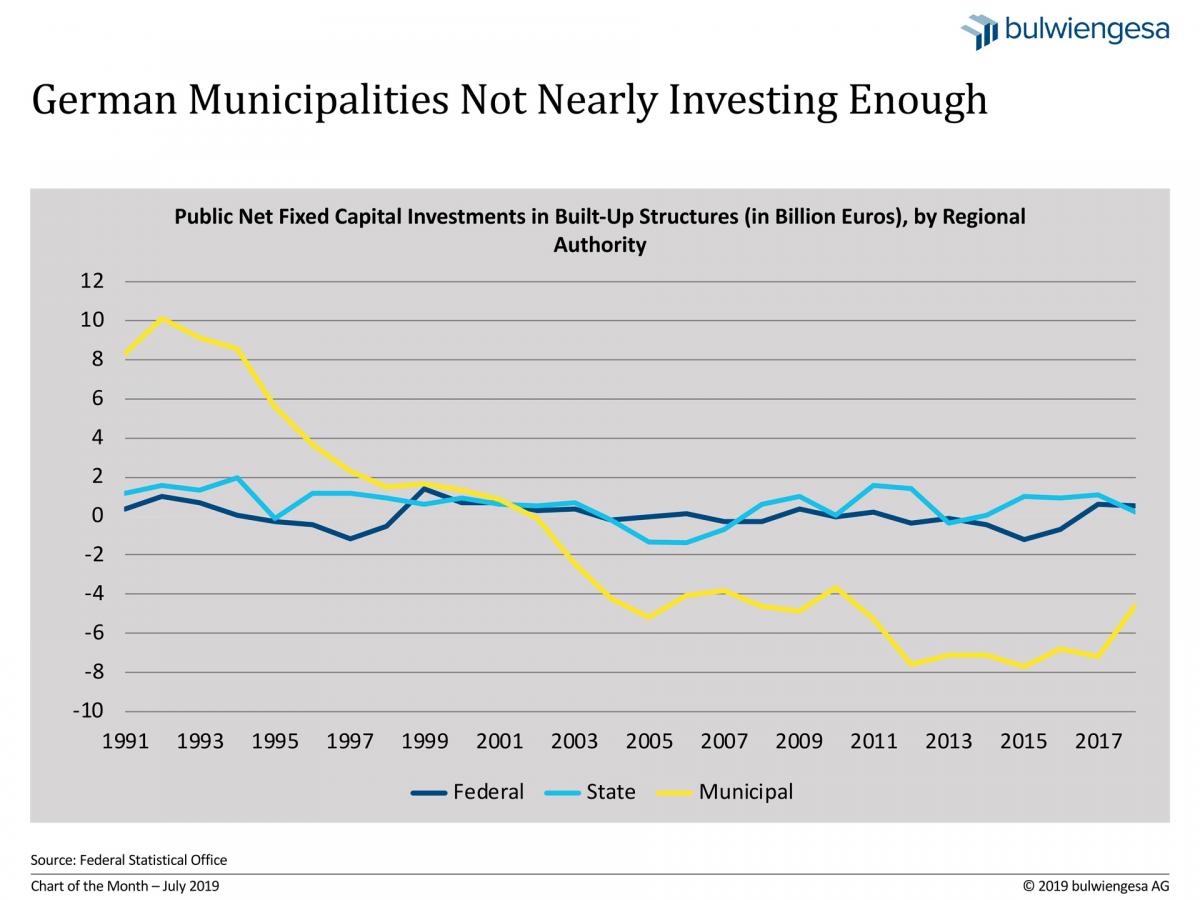

There is a massive shortfall in construction investments—not just as far as buildings go—and particularly so in German municipalities. The balance has been negative since 2002. At a time when the body politic is urging private investors to build more homes, there is growing doubt that cities and communities are adequately funded to handle this task.

High-spec infrastructure is a key prerequisite for the competitiveness and the growth potential of a given state. The latest chart published by the Federal Statistical Office clearly shows: Public net investments in buildings were quite lively after Germany’s reunification in 1990, but took a nosedive in the zero years, in some cases even crossing into the negative range. Especially municipalities were unable to expand, or indeed maintain, their capital stock. On balance, their investments in built-up structures have been negative since 2002. The latest figures show virtually no improvement. In 2018, German cities and communities invested over 4.5 billion euros less than they wrote off on their capital stock. Municipalities thus remain the problem child among Germany’s political subdivisions while the net fixed capital investments in built-up structures on the federal and state level have hovered around zero for years.

It makes perfect sense to be frugal and cut costs – as long as you don’t start cutting corners. More than other countries, Germany is now showing an investment shortfall of such a magnitude that it will jeopardise future growth and that will require billions in public and private spending to compensate. The International Monetary Fund (IMF) has tirelessly repeated for years how important it is that Germany spend more.

The number of homes now being built in Germany is higher than it has been in years. But it falls well short of the numbers needed. Virtually all experts agree on this, and so does the body politic. There is reason to believe that the supply trend will not be able to keep up with the housing demand in future either. Now, as then, low-priced residential accommodation remains in short supply in most German conurbations and university cities. The coalition agreement underlying the incumbent federal government therefore specifies that 1.5 million new flats would be created by 2021 and rent hikes on strained housing markets be curbed. Policymakers are urging private investors to engage in housing construction. However, regional authorities could also do their share, given the financing surpluses that accumulated on the federal level in recent years – but are all of the regional authorities actually capable of doing so? The municipal investment shortfall in built-up structures has increasingly raised doubts that cities and communities are adequately funded to handle this task. (Also see an article on the difference in spending on social housing in Bavaria and Saxony that the Immobilien Zeitung real estate trade paper carried on 17 June 2019.)

The housing policy has been, and continues to be, a key component of municipal public services. But the responsibility rests not solely on the shoulders of municipalities. Cities and communities do spend considerable sums to ensure their residents have access to affordable accommodation. But the task is too big for municipalities to cope with on their own. Federal and state governments should make substantial contributions to secure the financial leverage that cities and communities need in order to be able to act. Only if all of the players on Germany’s housing market coordinate their resources will their efforts truly make a difference. Cooperation rather than confrontation is of the essence to accomplish this formidable task – whereas the only outcome of the blame game among private and public investors or within the political subdivisions is that it keeps the gap between supply and demand on the domestic housing market from being closed – either indefinitely or until negative demographics resolve the housing shortage at long last. Not exactly a bright outlook for a (presumably) prosperous country.

Contact person: Martin Steininger, Chief Economist at bulwiengesa, steininger [at] bulwiengesa.de