March: Office Boom in A-cities Continues

March: Office Boom in A-cities Continues

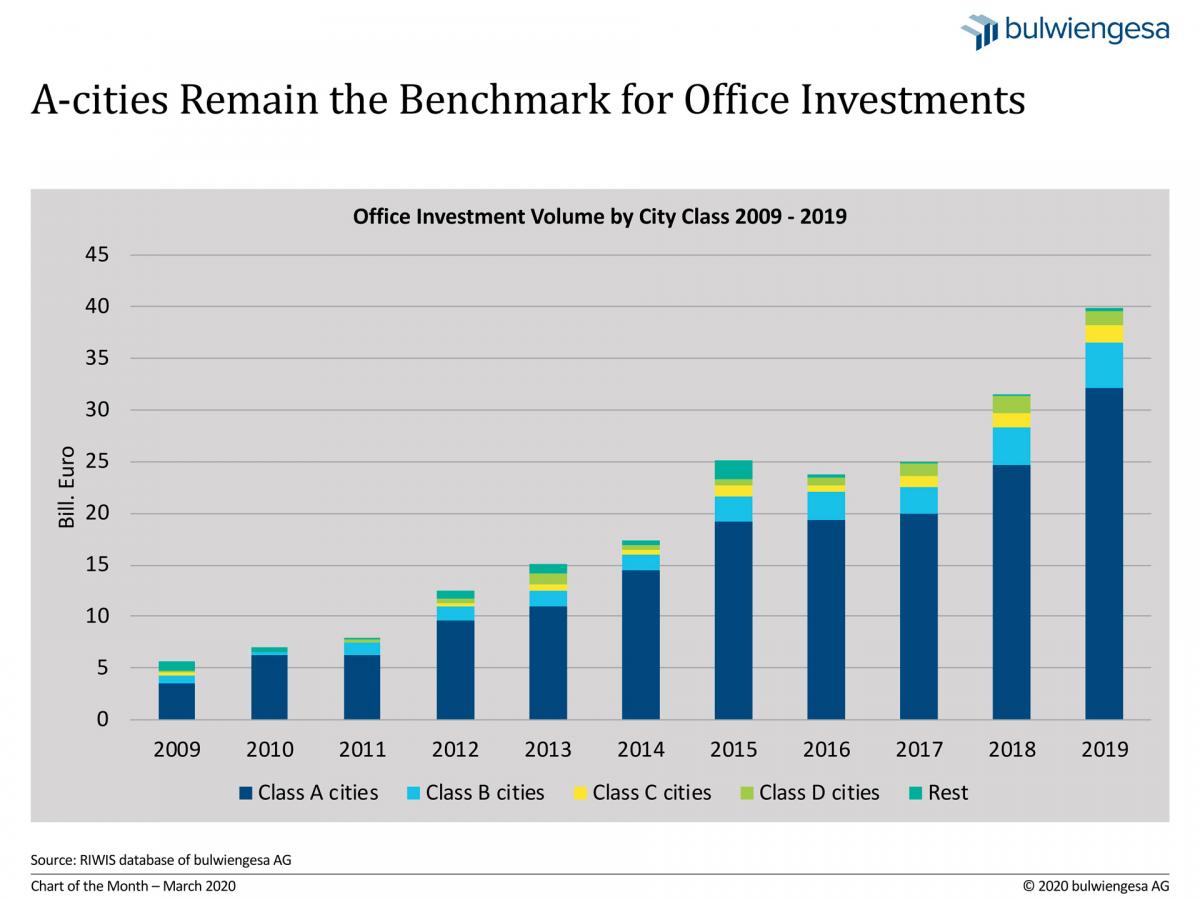

In 2019, the volume for office investments will total almost EUR 40 billion. This is the highest value ever documented. More than ever, the majority of these investments are in class A cities. There are several reasons for this popularity.

For example, the development of office workers. This is not only a strong trend indicator for the regional economic power, but also shows how the real estate market is performing. The positive development of employment and the resulting increase in the number of people employed in the office sector can thus also be seen almost directly in the office market - the class A cities are winning here. Thanks to their inner-city infrastructure and educational opportunities, the metropolitan areas benefit most from the influx of highly qualified workers and thus from an increase in office employment. On average over the last five years, Berlin has shown by far the highest growth of +16 %, well ahead of the equally dynamic locations of Munich with +12.4 % and Frankfurt and Cologne with +11 % each.

However, the trend of the past year is also continuing in the class B locations. Growth and also the proportion of all office employees are still on the upswing. Leipzig, Münster and Essen in particular are showing the greatest prosperity, almost on a par with the class A cities. Outside the larger office markets, development is much less dynamic and in some cases also declining. Only in university locations or cities with dominant anchor users does the development coincide with that of the class A and B locations.

The high demand on the user side, combined with steady rental growth in recent years and the low or successively decreasing vacancy rate, naturally leads to great investor interest. Another important reason for the popularity of office investments, especially in class A cities, is the increased product availability, as new construction activity has picked up in recent years. In addition, the general economic data continues to be predominantly positive, particularly with regard to the sectors relevant to the demand for office space, such as software/IT, e-commerce, information and communication technology, etc.

Overall, the class A locations represented around 80 % of the transaction volume of the office segment. This share within the office segment has fluctuated only slightly for years, which underlines the dominance of the class A locations for the investment market in the office segment. Compared to the previous year, the transaction volume in the class A locations increased very significantly by 30 % from EUR 24.7 to 32.1 billion.

In the class B markets, the sales volume in 2019 exceeded the EUR 4 billion mark for the first time. Both class C and D locations recorded slight increases in absolute terms, but remained well below the EUR 2 billion mark. Outside the larger cities, investment activity in the office segment remains of lower importance. Among the class B locations, Nuremberg is in first place with a sales volume in the office segment of almost EUR 1 billion. This is followed by Essen, Hanover and Leipzig with volumes already below 500 million euros.

Note: The text is a modified excerpt from the Spring Real Estate Industry Report 2020 by the Immobilienweisen Expert Panel for The German Property Federation (ZIA).

Contact person: Andreas Wiegner, Project Manager Investments, wiegner [at] bulwiengesa.de and Oliver Rohr, Project Manager Office, rohr [at] bulwiengesa.de