October: New Trend – More and More Investor Developers

October: New Trend – More and More Investor Developers

Germany’s market for property developments is seriously in flux. For classic trader developers, it is becoming ever more difficult to build, especially when it comes to residential development. Could this be an opportunity for investor developers?

The current capital market, the exploding land prices and the rise in construction costs have wreaked massive changes on the German market for property developments. For trader developers—meaning developers who acquire land, plan and execute its development, and resell it—building is becoming visibly more difficult, especially in the housing segment. By contrast, investor developers, who manage their portfolio properties after building them, can use their superior credit worthiness to negotiate more favourable funding terms. Their greatest potential is in the urban development context where the sustainability of their approach makes them the partners of choice for the development of entire residential quarters.

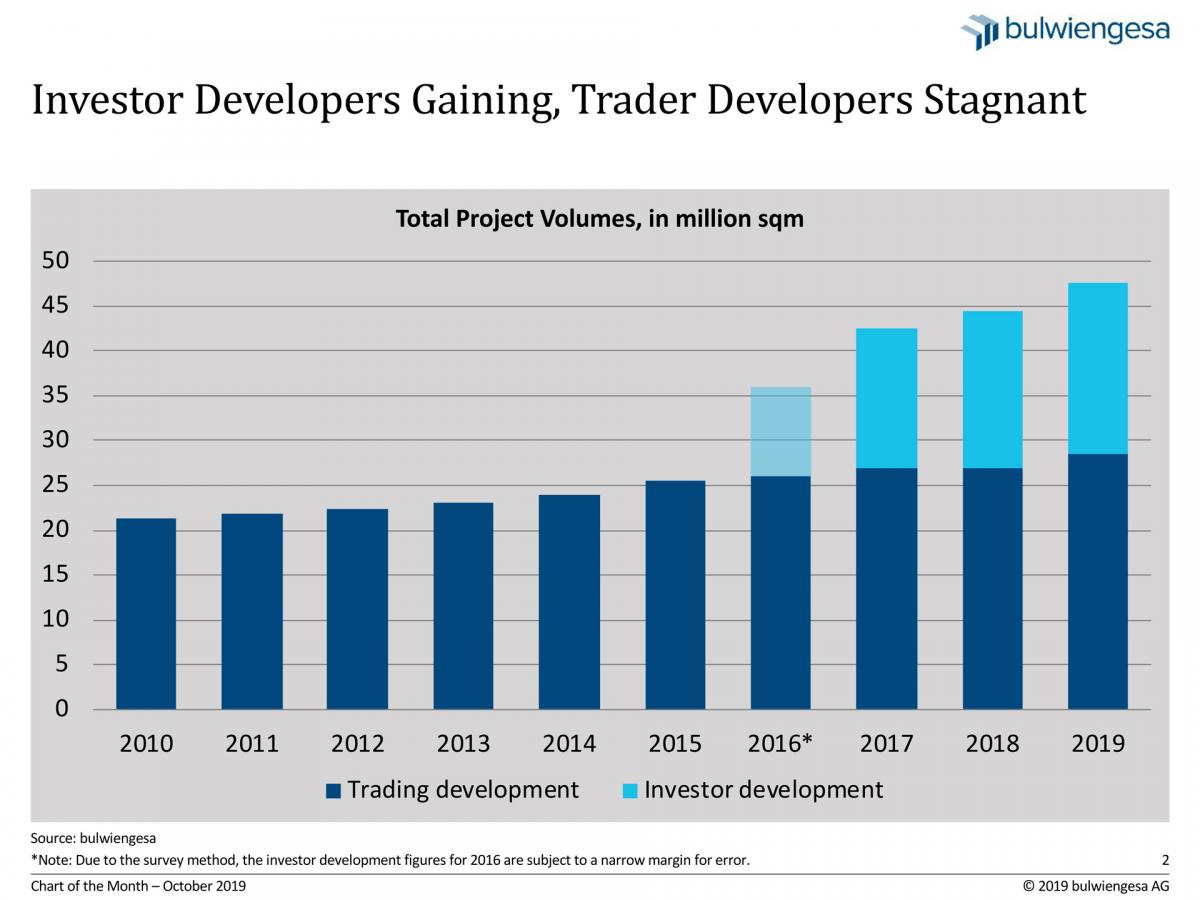

Over the past months, bulwiengesa compiled several surveys for investor developers that are based on the traditional Property Developer Survey, which was published together with BFW Federal Association of Independent Housing Companies in March of this year. The Chart of the Month impressively shows the growth of investor developers in Germany’s Class A cities: 19 million square metres will have been completed by investor developers by the end of a seven-year period (2016-2023), compared to 28 million square metres delivered by conventional trader developers. This means that the ratio is at 40:60 already.

The biggest players among Germany’s investor developers are

ABG Frankfurt,

CA IMMO and

BUWOG,

with CA IMMO being active largely in the office real estate market whereas ABG Frankfurt and BUWOG focus mainly on the housing market. Especially on the housing market, the latest investor developers include municipal companies. For instance, the housing companies GEWOFAG in Munich, GAG in Cologne, HOWOGE and degewo in Berlin account for around 300,000 square metres or more each in developments.

We believe that investor developers are further encouraged to engage in new-build housing construction by the currently low interest rates, a strong demand for real estate investments and political pressure for socially fair and functional modern cities. In the housing construction segment of Germany’s “Big Seven” cities, they already account for projects worth nearly 33 million euros. And the cycle for new office developments has only just begun. The weights in the construction sector of German cities are about to shift.

Contact person: Andreas Schulten, Chief Representative of bulwiengesa, schulten [at] bulwiengesa.de