Growth of Mega Distribution Centers Accelerates

Growth of Mega Distribution Centers Accelerates

Together with Buck Consultants International, bulwiengesa has analysed the European market for large-scale logistics properties. The most important results were summarised in a joint whitepaper.

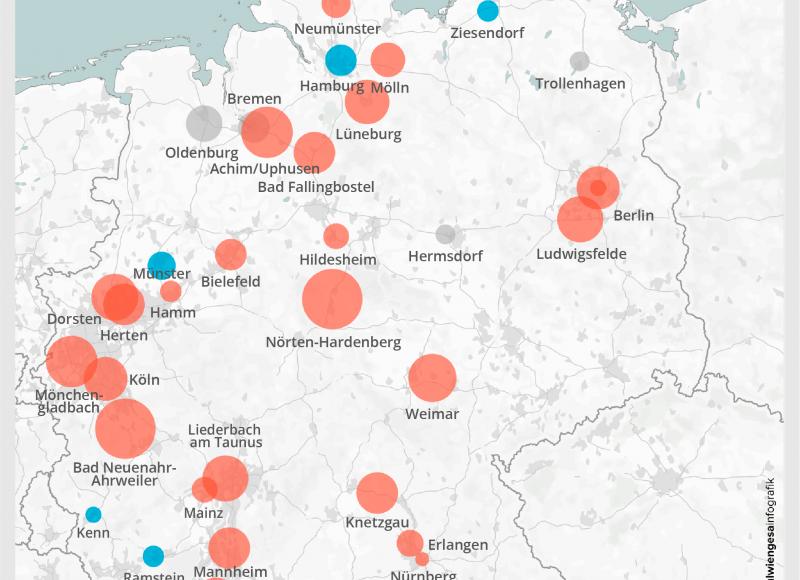

In the period 2013–2019 424 Mega Distribution Centers (each more than 40,000 sqm floor space) have been established or announced in the logistics heart of Europe. The majority of them were built in Germany (285; 67%), followed by the Netherlands (98; 23%) and Belgium (41; 10%). Altogether these 424 XXL warehouses have 28.9 mln sqm floorspace. In the last 5 years there is a clear acceleration in the establishment of these XXL warehouses: in 2018/2019 an increase of 57% in the three countries compared with 2015–2017, with the Netherlands having an above average increase of 100%, while Belgium saw similar figures in the two periods.

These conclusions are drawn in a white paper on Mega DCs, released today by bulwiengesa and the real estate consulting firms Buck Consultants International (headquartered in Nijmegen, the Netherlands with offices in Europe, the US, China, Singapore). Based on a common research interest, the two companies have combined their databases to investigate for the first time the growth of Mega DCs in Germany, the Netherlands and Belgium with a fixed set of definitions.

The demand for logistics warehousing has been growing in the past years due to a number of factors:

- The booming pre-Corona European economy, leading to more consumer and business demand.

- The rapid growth of e-commerce, leading to more demand for specific e-commerce warehousing with e.g. packing and return logistics facilities.

- The growing global trade, which has led to an increase in European distribution solutions at American and Asian multinationals.

- The low interest rates which makes financial investments in warehousing attractive.

The increasing demand for logistics services, driven by technological and social change, confronts the actors with the task of aligning their location networks to this additional demand. The decision criteria are in conflict between specific location preferences and restricting factors such as the availability of land for development or employees. One catalyst for the growing importance of logistics is e-commerce and the supply of end consumers, which is becoming increasingly important. In practice, obstacles have been encountered in many places to realign locations close to consumers. A high level of competition for building land – especially in the major cities – means that compromises have to be made in the choice of location in many places. The search for a stable location for the future is therefore a complex undertaking for which there is no single solution.

Contact person: Patrik Völtz, Principal Investigator for Logistics Real Estate and Unternehmensimmobilien at bulwiengesa, voeltz [at] bulwiengesa.de