Logistics: Short Supply Despite Completions Record

Logistics: Short Supply Despite Completions Record

As the year draws to a close, it is becoming clear that 2019 will be yet another banner year in logistics real estate completions. This is remarkable insofar as many important logistics locations show a massive shortfall in plots of land. Here is another finding of the latest “Logistics and Real Estate 2019” survey: Domestic companies are warming to this asset class in steadily growing numbers.

The shortage in available land plots in some logistics regions is causing the keen demand for space to go unmet. Indeed, the quest for alternatives is already under way. Investors and developers are gravitating increasingly toward peripheral sites. And, of course, you could to worse than finding functioning alternatives on the periphery that also satisfy the safety requirements of logistics operators and property developers.

Few people doubt that the demand for logistics real estate will maintain its current level in future. Factors suggesting as much include the changed consumer demand and the dovetailing of logistics and production, but the linchpin factor is the undisputed macroeconomic significance of logistics. Construction activities cannot keep up with demand either.

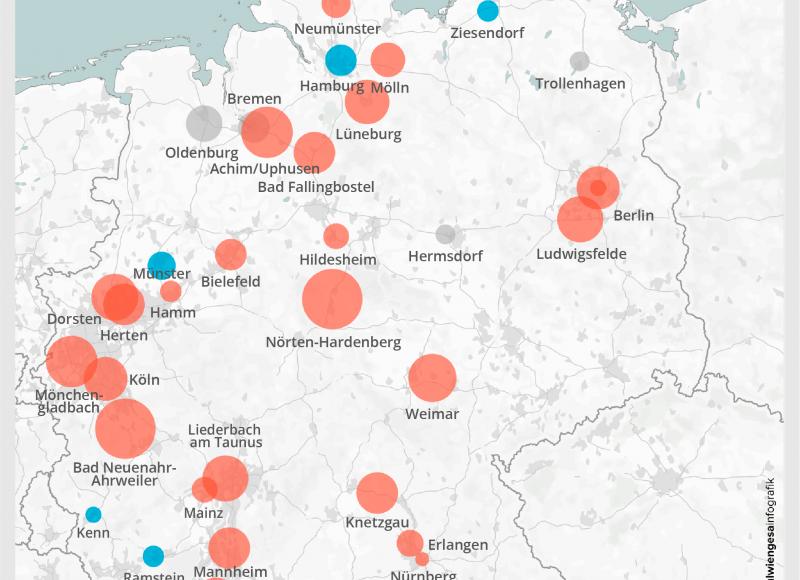

Our new mathematical model (see the “Chart of the Month” for November) captured the regional demand for additional logistics accommodation across Germany. It adds up to more than 6.5 million square metres annually. The identifiable extra demand for accommodation is particularly high in some peripheral regions of the larger states, such as Baden-Württemberg, Lower Saxony and North Rhine-Westphalia. Unlike the established metropolitan logistics regions of Hamburg and Berlin, where demand for additional logistics facilities is also extremely high, these states have far more options for zoning the required development land.

The latest evaluation shows that, while the development of logistics facilities continues to be centred in the established logistics regions, it gravitates more and more toward the periphery of these regions as well. Property developers and investors favour locations close to conurbations. Other factors that matter to them include the proximity of transport nodes, additional land reserves and the multiple occupancy capacity of a given property.

But there is no way to cover the strong annual demand for additional logistics space unless you radically step up the building activity. Then again, there are certain other alternatives for relieving the shortage of accommodation, e.g. through infill densification, brownfield development, by restructuring existing trading estates, by merging plots or by building multi-storey assets.

More and More Domestic Companies Enter the Investment Market

The latest survey, “Logistics and Real Estate 2019”, also returned the following insight: A steadily growing number of domestic companies are discovering the opportunities this asset class presents. International companies have been aware of the appeal of logistics real estate as an asset class for a long time and managed to secure large holdings, most notably through portfolio acquisitions. Despite the regressive tendency, international players maintain a strong presence in the market, especially those from other countries in Europe and from Asia. At the moment, their share of the German logistics investment market equals around 50 %.

By the survey’s baseline date (19/08/2019), there were only seven German companies among the 20 leading investors. But their investment total this year to date, which adds up to c. 1.1 billion euros, equals around 58 % of their year-end total of the year before.

The top spots of the ranking (again as of the baseline date) were claimed by Blackstone and Frasers Property Europe. Next in line are China Investment Corporation (CIC) in third place and Garbe, a German logistics property developer and investor, in fourth place with approximately 1.2 billion euros invested. Goodman Group ranks fifth. Garbe Group is admittedly the only German market player among the top 5. But the top 10 list includes another three domestic investors, these being RLI Investors, Palmira Capital Partners and PATRIZIA.

Compared to other asset classes or countries, German logistics real estate stands out with a high rate of return. However, the hardening of yield rates has noticeably narrowed the gap to other types of real estate. The fact that Germany is characterised by a comparatively high degree of industrialisation and a high owner-occupancy rate translates into diverse options for investors to buy in. Moreover, the appeal of this asset class is boosted by its low cyclicality and its high cashflow returns.

About the “Logistics and Real Estate” Survey

“Logistics and Real Estate” is an independent survey series published by the Competence Centre for Logistics and Real Estate that comprehensively captures the asset class of logistics real estate from various angles, and that has already established itself as a leading survey series for logistics real estate in Germany. The commercial real estate lender Berlin Hyp AG, prime contractor BREMER AG, real estate group Garbe Industrial Real Estate GmbH, and the real estate consultancy firm Savills Immobilien Beratungs-GmbH have partnered with bulwiengesa to assist with the survey design, and have shared valuable insights into their respective market segments.

You can download the full-length survey.

Contact person: Tobias Kassner, Head of Division Industrial and Logistics Real Estate at bulwiengesa, kassner [at] bulwiengesa.de