Logistics Regions: Potential Beyond the “Big 5”

Logistics Regions: Potential Beyond the “Big 5”

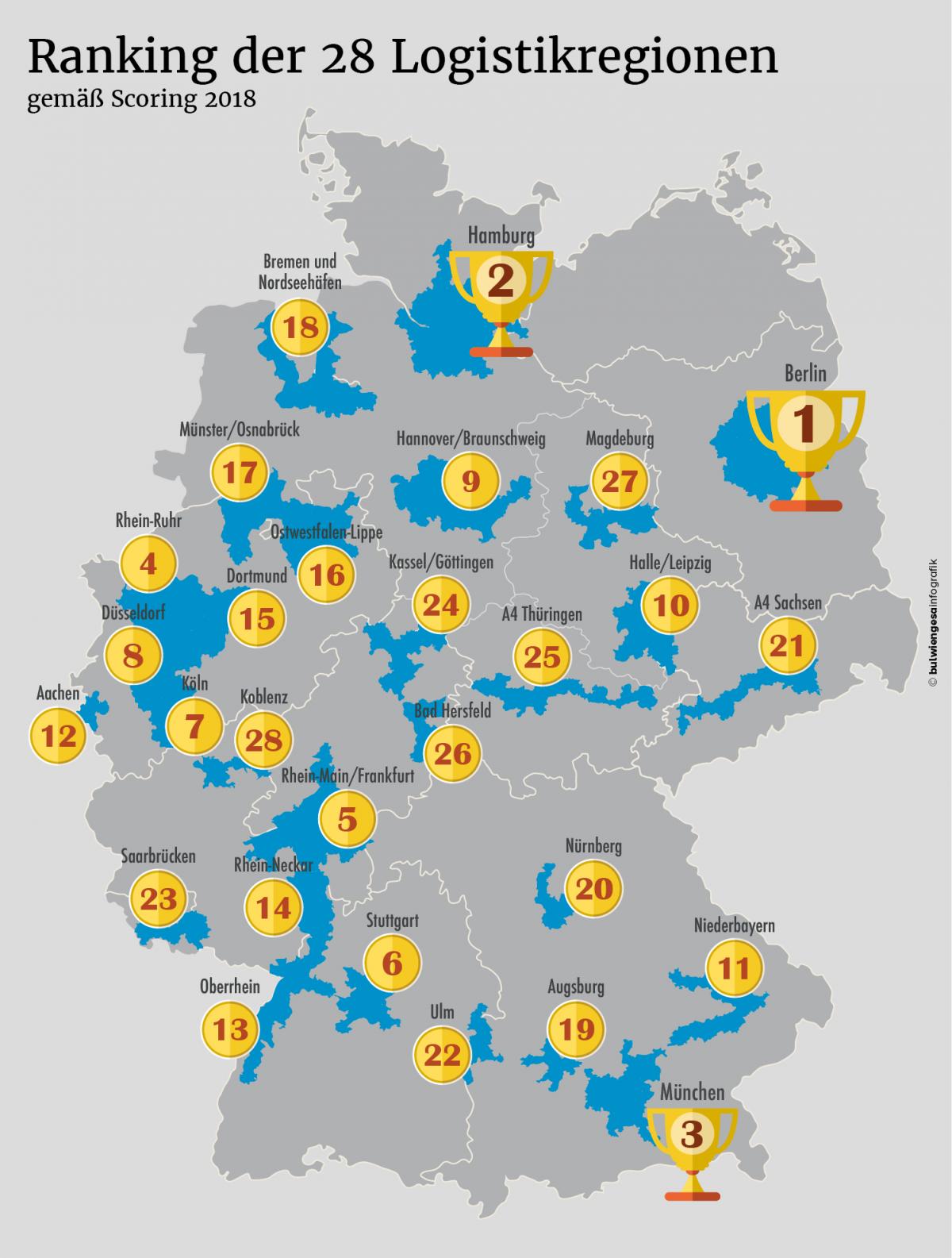

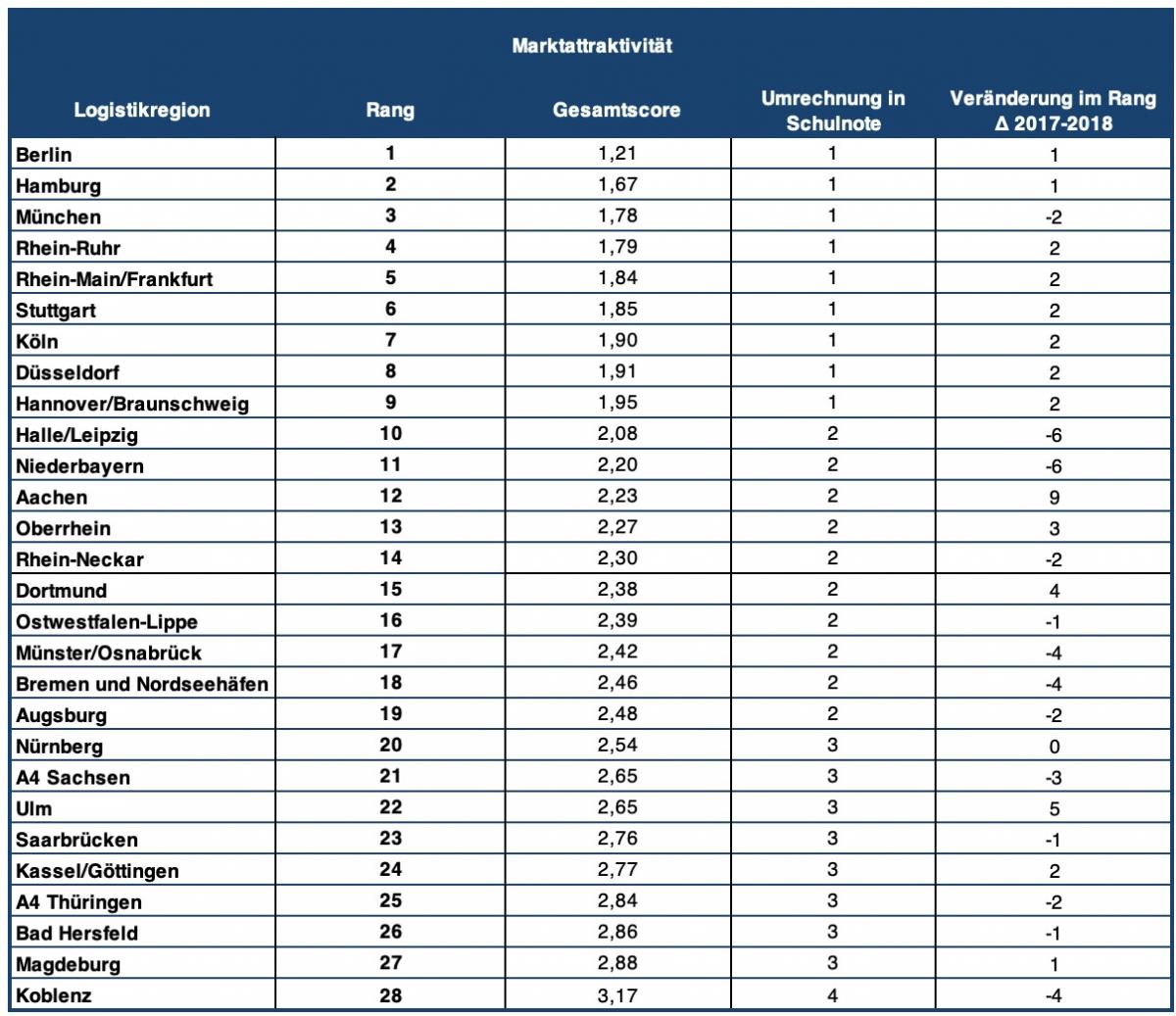

While the significance of the “Big 5”—meaning Germany’s five largest logistics regions—is undisputed, the German logistics business is by no means limited to the metropolises. The distribution of goods obviously constitutes one of the cornerstones in logistics, so that being close to the major sales markets is of the essence. And, of course, these markets are most prominently positioned in the metro regions. But the latest scoring, the one for 2018 published here for the first time, shows: The average score values have gone up for all of the regions.

What is the purpose of the scoring? The location of logistic properties in sustainably attractive logistics regions has enormous significance for logistics operators, property developers, investors and financiers. While owner-occupiers sometimes base their decision in favour of a location on very specific criteria, the mentioned players place a premium on optimal sustainability in real estate economic terms. The scoring model applied by bulwiengesa measures the market attractiveness of the logistics regions once a year. It integrates market data such as logistics real estate construction and investment volumes as well as other real estate economic values.

Top 3: Stable

Just like in previous years, the top spots in the attractiveness ranking are taken by the leading logistics regions of Berlin, Munich and Hamburg. Berlin made above-average gains year on year.

Especially the development of rents in Berlin is worth noting. In 2017, the prime rent had still been c. 5.00 euros/sqm. In the course of 2018, the rate soared by more than 10 %: The prime rents quoted for modern logistics properties rose to 5.60 euros/sqm. The appeal of Berlin’s market is defined by its special role as a dynamic consumer market, among other reasons. Human resources are also available in the logistics region, which is no longer the case in Munich, for instance, or is subject to elevated costs. For Berlin, the year was moreover defined by strong investment demand, which set it apart from Hamburg and Munich.

Hamburg ahead of Munich

Hamburg positioned itself ahead of Munich in 2018. The performance illustrates the dynamic of the market in Hamburg, which is rooted in strong supply and demand scores. Hamburg is also far more attractively positioned than the Munich logistics region in regard to land prices, as prices in the north are not nearly as high.

The Ruhr Catching up

The Rhine-Ruhr logistics region further improved its position year on year. As a very populous and densely populated region, it is home to important locations for the regional and national distribution of goods. The wide-spread structural change impacts the locational requirements of logistics operators, too. In 2018, the logistics region reported the best upper score in terms of investment demand. It also achieved one of the highest scores on the demand side. The city’s overall scoring trails that of Munich by a very narrow margin only. Assuming the strong demand is sustained, it stands a good chance to score a place among the top 3 in the ongoing year of 2019.

Top Score for Hanover/Braunschweig for the First Time

The region is probably a blank spot on the map for many market players—but this is likely to change soon. Because the Hanover/Braunschweig logistics region in the heartland of Germany achieved an overall scoring for the first time that would translate into a “straight A” school report card. It is a logistics region that rests on a robust foundation and boasts a compelling supply score in particular.

Overachiever: Aachen

Having placed 12th in 2018, Aachen improved its position in 2018 by nine ranks year on year. This makes Aachen the logistics region with the greatest positive change within a year’s time. Aachen achieved particularly high rent and property scores. Inversely, Halle/Leipzig and Lower Bavaria count among the losers of the latest ranking. Reasons for dropping six ranks year on year include sub-average investment demand in these regions.

Note: This article was originally published in DVZ Deutsche Verkehrs-Zeitung on 20/03/2019.

Update in May 2019: Due to a data basis update (20/05/2019), which includes revisions of the latest quarter-end figures, the rankings shifted slightly. The Cologne logistics region is now in 7th place whereas the Düsseldorf logistics region is now in place 8.

Contact person: Tobias Kassner, Head of Division Industrial and Logistics Real Estate at bulwiengesa, kassner [at] bulwiengesa.de