Logistics Beyond the Hype

Logistics Beyond the Hype

The bread-and-butter business of logistics is transacted outside the city gates. But what makes a sound logistics region depends strongly on the market segment. Increasingly, it is also defined by the degree to which is can be customised for flexible use.

The hype generated by the subject of city logistics or urban logistics is as rampant as ever. Articles on the subject are published more or less on a weekly basis. Without doubt, urban logistics is of key significance for the future development of cities and of logistics real estate as such. But there is one thing that tends to get overlooked: Without the “bread and butter business” of logistics operators, Germany’s economy—to stay with the image—would be facing lean times or starve. Now, as then, urban logistics remains but a niche product while the bulk of the logistics business takes place more or less unnoticed outside the gates of major cities. This is where the raw materials for manufacturing are transshipped and goods distributed—in a word, where the macro-economy’s lifeline is located.

And so, the long-established segments continue to dominate the market. They account for the bulk of the demand for logistics facilities. Naturally, one sector that figures prominently in this context is freight and transport logistics. It is the sector that generates by far the highest take-up. Its occupiers favour primarily locations within the leading logistics regions. Next in line are the occupiers in the sectors automotive logistics and e-commerce, which generated a massive demand for logistics accommodation over the past years. Especially production-related logistics sectors tend to settle outside the major logistics region as well. The “Competence Centre for Logistics Real Estate,” whose members include the companies bulwiengesa, Berlin Hyp, BREMER, GARBE and Savills, and which presented its fourth survey on logistics and real estate at the Expo Real 2018 trade fair, will publish useful guidance in the form of a custom-developed scoring system.

The Economy is Booming, and Investors Fancy Logistics Real Estate

Logistics real estate has long been on the radar of investors, too: In Germany, it is currently the real estate asset class with the highest growth rates.

The country’s export-driven economy and robust domestic demand that is driven by up-beat consumer sentiment among the general public necessitate an ever-tighter network of logistics properties of every sort in order to sustain the production and supply chains. Without the logistics business and the real estate it requires, the economy would stall. As banal as this may sound, it does illustrate how important the interaction of logistics industry and real estate industry is for the macro-economic development. The latest survey presents a picture of sustained outperformance – driven by persistently strong demand. That being said, Germany’s metro regions are running out of land fast.

New-Build Construction, Almost Anywhere You Look

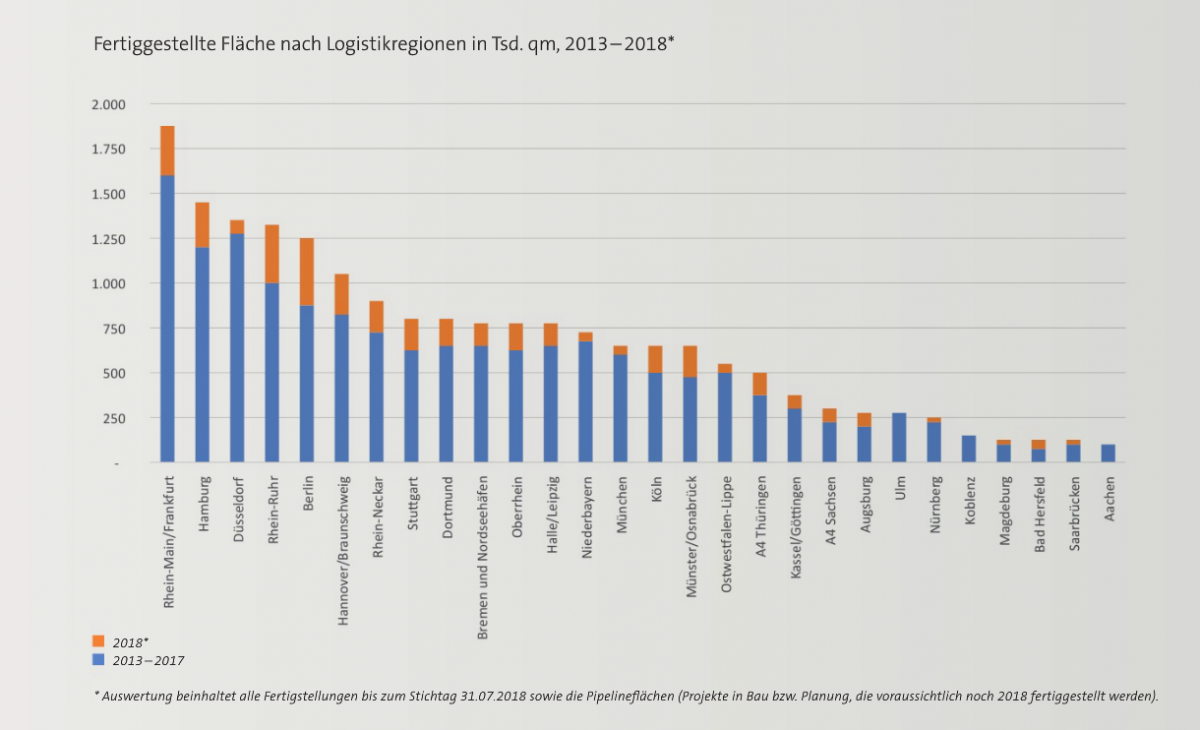

At the same time, there is heavy building activity: With 4.6 million sqm of new-build logistics space coming on-stream, 2017 achieved the highest completions volume within a calendar year since the market observation was launched. Even if the forecast of the previous year’s survey predicted a slightly higher figure, this outcome marks a peak level nonetheless. 2018 will be the first in many years that will see a dip in new-build completions; a completions volume of slightly over 4.2 million square metres now appears to be realistic (as of 31/07/2018).

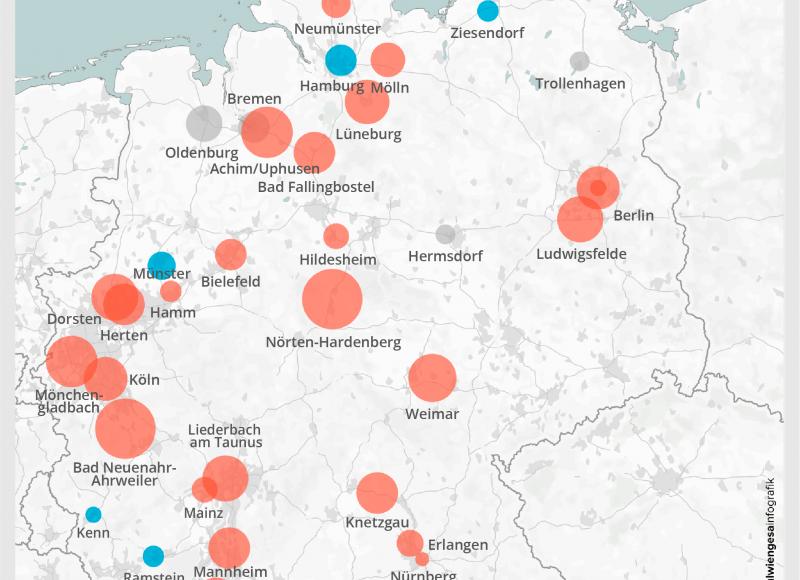

Construction activity continues to be reported from the established logistics centres as well as from the periphery, even if large-scale logistics properties have a hard time finding eligible sites. The five leading logistics regions were slightly reshuffled during the long-term observation period of 2013 through the end of July 2018. Rhine-Main/Frankfurt is easily the busiest region in terms of building activity. It remains in the top spot with a completions total of 1.9 million square metres of completed floor space, followed by Hamburg (up from third place the previous year) with 1.4 million square metres and Düsseldorf (down from second the previous year) with over 1.3 million square metres.

Growing Occupier Requirements Make Life Complicated for Investors

One thing is certain: Investing in logistics real estate is getting more demanding because of rising requirements on the occupier side. That being said, the yield prospects for logistics real estate investments are still comparatively high. Yet the profitability in this segment hinges on certain parameters, such as a property’s flexibility. Assets with high scores include customizable properties conveniently connected to an airport and to the motorway, railway and waterway networks. The option to obtain a license for running a 24-hour, three-shift operation will also boost the yield opportunities considerably. Another factor increasingly credited with higher yield prospects is the length of the lease term. However, leases for large units in particular tend to be negotiated for noticeably shorter terms now. In 2017, the share of lettings for terms of more than ten years is just half of what it was in 2013. It is one more reason to ensure that a given logistics property can be put to alternative use in the future with another or even third type of occupier.

Note: This article was orignally published in LogReal.direkt 04/2018 (in German).

Contact person: Tobias Kassner, Head of Division Industrial and Logistics Real Estate at bulwiengesa, kassner [at] bulwiengesa.de