February: Real Estate Sector Unimpressed by Current Economic Lull

February: Real Estate Sector Unimpressed by Current Economic Lull

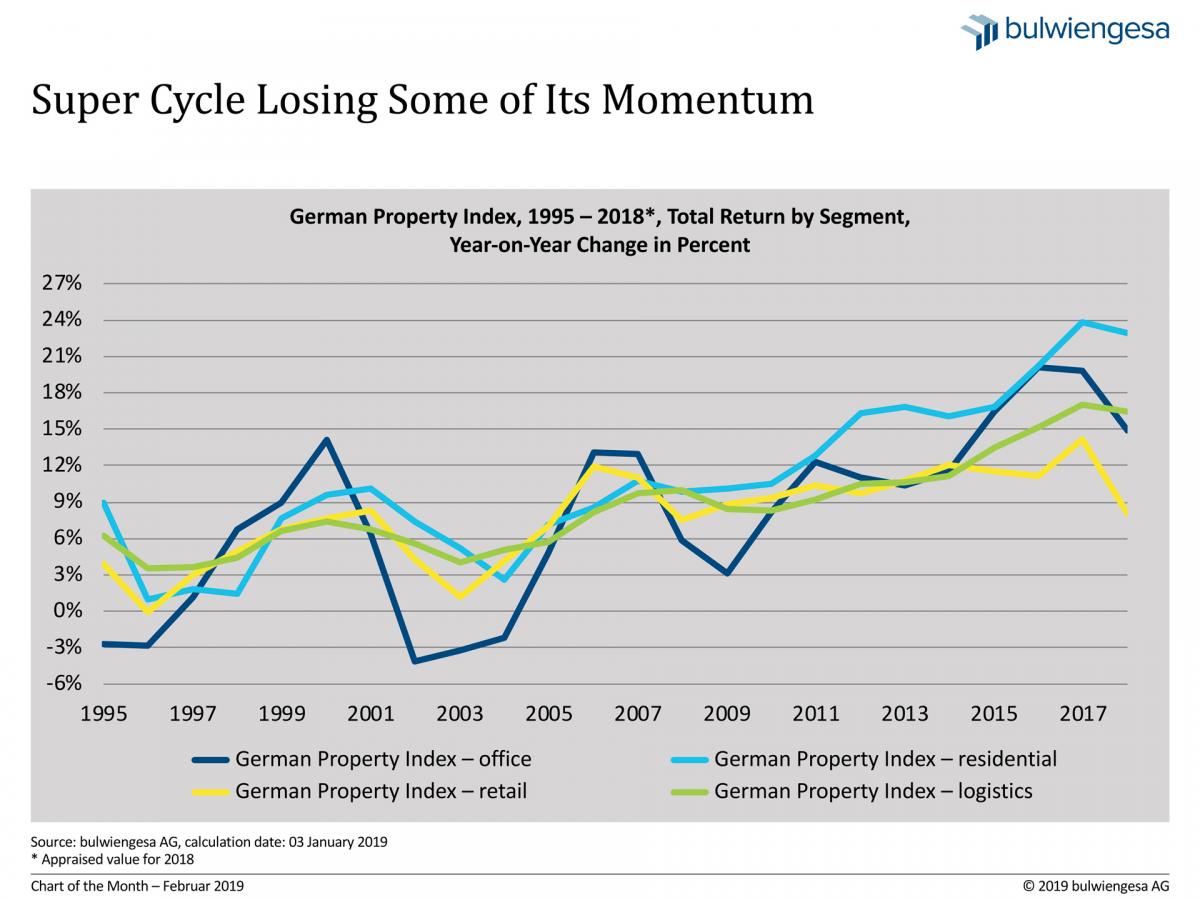

The German Property Index (GPI) quotes the total returns for German real estate investments. You can tell at first glance that the “super cycle” has lost some of its momentum.

The total return on German real estate investments in 2018 proved unable to top the growth achieved in 2017 – after all, it had been the fastest percentage growth since the German reunification in 1990. But even the year-end total of 2018 implies a substantial one-year growth rate in the double-digit range. The “super cycle” may be losing some of its momentum, yet the trend remains the same.

The score calculated for 2018 is the third-highest one-year percentage rate of change for total returns in the annals of the Germany Property Index. The main reason for top scores across all segments—excepting retail—is the persistent demand backlog on the investment market and the rent growth seen in recent years.

As a result, the investment market for commercial property and residential portfolios crossed the mark of 75 billion euros in 2018. Despite the increased level of uncertainty regarding the global economy, German real estate is still held in high esteem by domestic and international investors. Among the drivers of this process are, most notably, foreign investors who seek to exploit the yield or foreign exchange differences to their domestic currencies. In this context, the unchanged near-zero interest policy of the ECB fuels the current market action. The low rates of return must be blamed on the low level of interest rates, above all, and less so on fundamentals.

About German Property Index (GPI)

The German Property Index (GPI) is a real estate performance index compiled by bulwiengesa based on available market data, including from the RIWIS database, among other sources. The GPI maps the total return and is obtained from the capital growth return and the cash flow return. Performance indices covering the segments office, retail, residential (new-build and existing) and logistics are available for 127 market cities. This differentiation by region and sector facilitates the calculation of benchmark figures for German real estate portfolios, for example. Based on the forecasts, which take existing market intelligence into account, market developments are anticipated and can help with investment decisions.

Contact person: Martin Steininger, Chief Economist at bulwiengesa, steininger [at] bulwiengesa.de