March: Yield Drop in Class A Cities Slowing

March: Yield Drop in Class A Cities Slowing

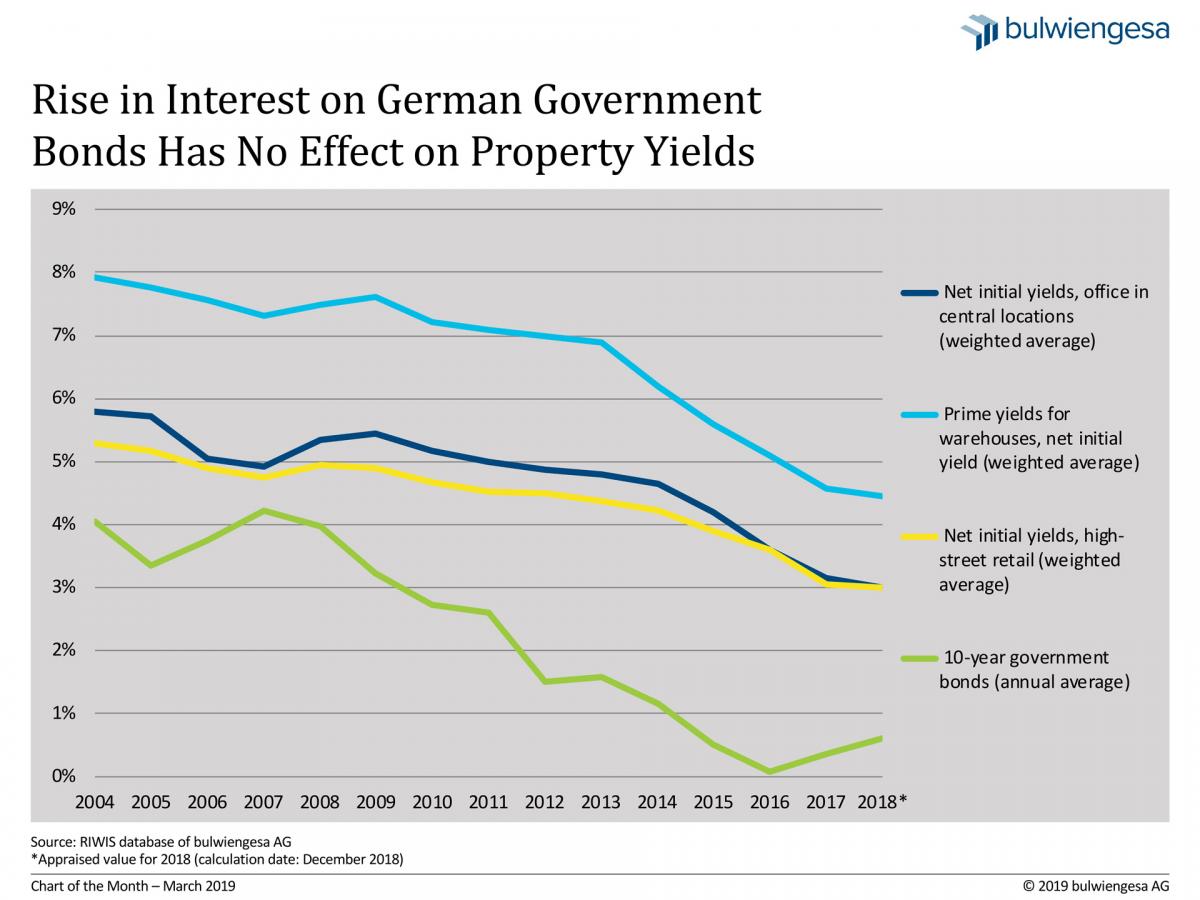

The chart from our chapter in the 2019 spring report shows: The price spiral in Germany’s “Big Seven” cities has noticeably slowed down lately. What may we expect from such a market cycle?

The price spiral has been rotating at considerably slower speed lately so that for many investors, commitments in the Class A cities with their high price levels have ceased to be profitable. They have increasingly shifted their gaze toward alternative locations in search for higher rates of return on the capital employed. Yet the volume figures actually relate a different message – namely that investments in Class A cities are stable. For the 2019 Spring Report by the Real Estate Industry that is published by the ZIA German Property Federation, we analysed the commercial real estate of the types office, logistics, hotel and Unternehmensimmobilien.

The investment turnover for commercial real estate in Germany’s “Big Seven” cities climbed to 38.4 billion euros, the highest volume on record. This translates into a 62.9 % share of the German total, the highest ratio since 2013. Apart from the high share of office transactions in the overall volume—the bulk of which is transacted in the high-priced Class A cities—the absence of larger, inter-regional portfolio deals is another key factor to explain the development.

#Outside the key investment hubs, c. 23.4 billion euros were invested in commercial real estate in 2018. Although this falls 16.7 % short of the prior-year figure (28.1 billion euros), it is still on a level with the 5-year average – for what it’s worth.

However: Some of the investment markets, especially those in B and C class cities, offer generally excellent economic and property-specific parameters, and have established themselves as investment safe havens with core investment opportunities and attractive risk-return profiles. In addition to transactions involving retail formats that always tend to be in demand and logistics real estate, these places registered a substantial increase in office deals. Cases in point include the Stern RellingHaus service centre in Essen, the “Hub 31” business incubator in Darmstadt and Podbi-Park in Hanover.

So, which way forward? Investments are likely to have peaked in 2018, and the sum total invested in commercial real estate will definitely be reduced in 2019. Due to the anticipated contraction of the business cycle, the investment pressure will probably ease. This would cause yield rates to stagnate, while rents will continue to act as main driver of the price trend. Accordingly, there is reason to expect flatlining prices.

Contact person: Andreas Schulten, Chief Representative of bulwiengesa, schulten [at] bulwiengesa.de