Will Berlin as Office Location Be Left Behind? Far from It

Will Berlin as Office Location Be Left Behind? Far from It

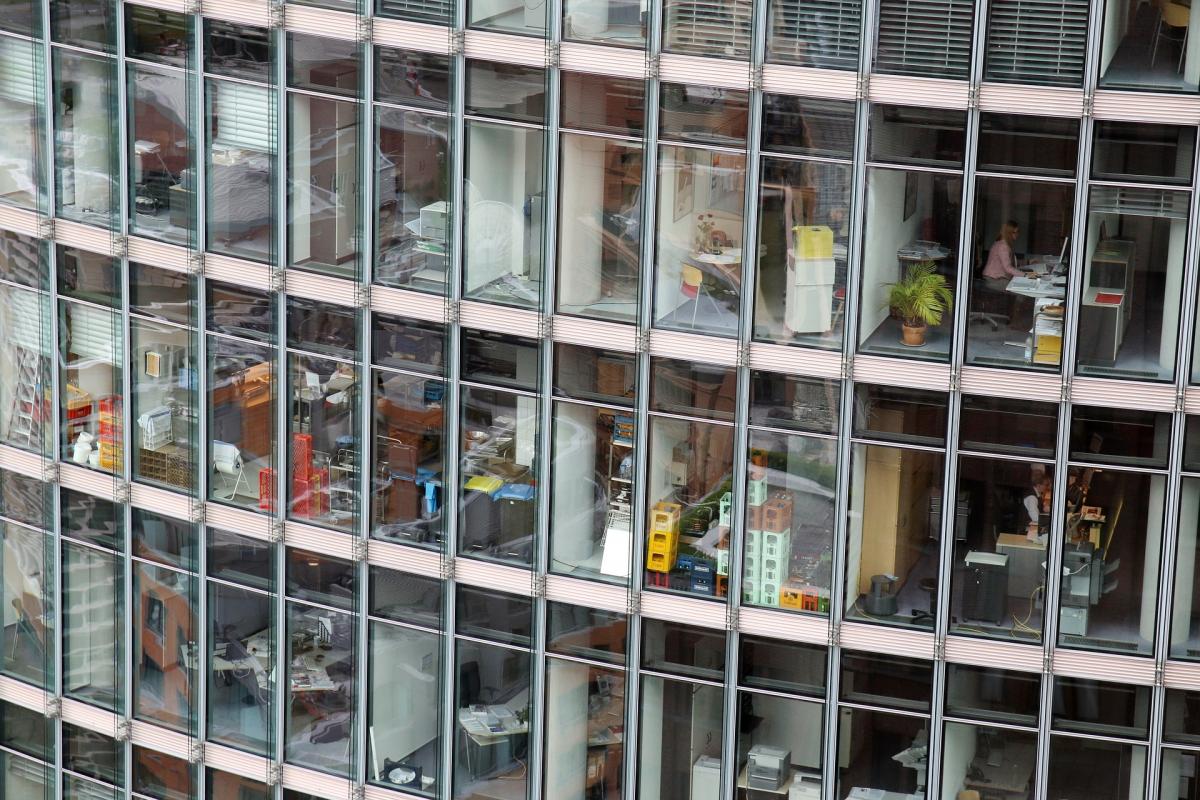

Search and you shall find? Companies looking for new office accommodation—be it in order to up-size or down-size, be more centrally located or occupy newer quarters—have a hard time in Berlin these days. The market is swept clean, and prices are up. Many have decided to shelve their plans for the time being and to stay put. But despite the shortage of space and runaway prices, there is no reason to worry that this market may be falling behind.

It all started on such a promising note, when Berlin experienced a construction boom between 1997 and 1999. But demand failed to pick up speed, and one in ten offices stood empty at the time. For what it’s worth, it was this situation that helped Berlin to gradually evolve into the “start-up capital” of Germany. The vacancies have since been absorbed by the market, and the bottleneck in affordable housing has for some time been matched with a shortage in offices. Without doubt, Berlin’s office real estate market has become a relevant sector for the city’s development over the past years.

But despite the shortage of space and runaway prices, there is no reason to worry that this market may be falling behind. To be sure, the situation is strained, uncertainties define the current real estate market action. And yes, there are several conceivable scenarios if market conditions deteriorated that could threaten to bloom into a crisis. One example would be the expansion of the rent freeze to include commercial real estate. It would make commitments in Berlin unattractive for investors, especially foreign ones, and would have largely negative consequences for the office real estate market. But how realistic is it to anticipate such a scenario for Berlin? And what factors would it depend on?

The latest market figures point to a modest slowdown of the German economy. But Germany’s labour market remains robust, as does demand for office workers. The situation is reflected on Berlin’s office real estate market, and it speaks against a looming crisis. With a population increase of around 40,000 people annually and as a result of the strong incoming migration, among them many highly skilled professionals, Berlin boasts the fastest office employment growth among Germany’s major cities.

Start-ups and digital companies have long grown up to become major players on the office real estate market. By mid-2018, digital companies accounted for 25 % and start-ups for 10 % of Berlin’s office take-up. We see no evidence suggesting a general trend reversal for commercial real estate in Berlin. Rather, the development is driven forward by a sustained urbanisation trend and upward demographics. That being said, the critical supply contraction for office accommodation in combination with persistently keen demand does pose a problem. Berlin’s office market registered an extremely low vacancy rate of barely 1.5 % in spring 2019 – making things difficult for companies that are planning to move here – pretty much as difficult as it was in previous years. To qualify as an adequate fluctuation reserve that ensures optimal market conditions, including stable rent levels and a larger supply in office accommodation, the vacancy rate would have to be somewhere between 3 % and 5 %. Fortunately and unlike other German metropolises, Berlin still has potential development land that could fill the floor space pipelines through stepped-up building activity and accelerated approval procedures in future. Meanwhile, keen demand and steady office employment growth ensure that constructing offices on speculation remains lucrative business for property developers. It would surely not take long to find a buyer or tenant.

The situation on Berlin’s office market would look very different if it were subjected to rent control and if the global economy were to take a dip. But the heterogeneous structure of demand and the strong non-cyclical demand for offices that is generated by the public administration point to a well-prepared market sector; as previously shown during the global economic crisis of 2008/2009. But won’t Berlin’s office market be hit by a crisis eventually? Assuming it were to suffer a blow, then the locations affected would be the ones on the city’s periphery with poor accessibility and infrastructure, whereas central, relatively stable-valued locations would hardly feel it.

Note: This piece was originally published in the magazine Immobilien Aktuell in October 2019.

Contact person: Alexander Fieback, Head of Office and Commercial Real Estate Berlin, fieback [at] bulwiengesa.de