Coworking in Berlin: Just a Hype?

Coworking in Berlin: Just a Hype?

Take trendy quarter or prestigious town core: At the moment, coworking spaces—or better put: “flexible workspaces”—are springing up everywhere in Berlin. The phenomenon is largely driven by the rapidly expanded start-up scene, but not exclusively so. In the market report for Berliner Sparkasse, we asked the question: Will this remain just a hype?

Berlin in its perceived role as the German capital of start-ups has attracted numerous co-working providers. And their target group is no longer limited to start-up businesses. Even large companies are increasingly drawn to the supposedly innovative workplaces. The advantages of doing so, such as flexible lease terms, an extensive range of amenities and the proximity to young innovative companies, seems to be more attractive than renting offices on your own. The phenomenon is reinforced moreover by the dire shortage of space on Berlin’s office real estate market.

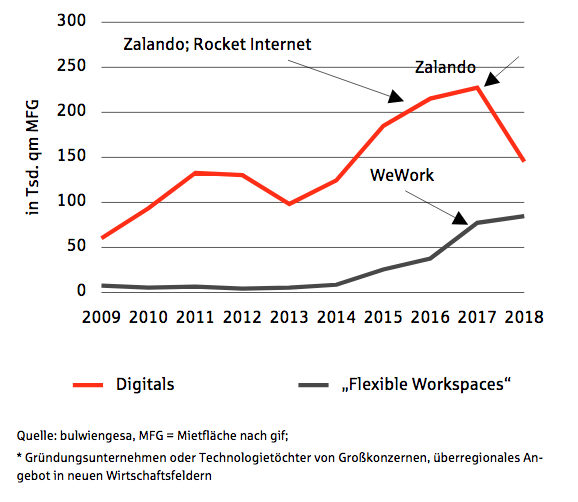

So, does the growing number of coworking providers merely represent a short-lived fad on Berlin’s office real estate market? Or are we halfway through a profound structural change? One thing is certain: The boom among Berlin’s digital companies is directly linked to the rapid spread of coworking locations.

Hybrid Models, Rather than Coworking Models, Now Dominate the Market

For a long time, coworking was considered synonymous with a young, innovative and flexible approach. Young start-up businesses in need of a desk gravitated more or less automatically toward a coworking space rental. Things have changed though. Lately, major companies have come to dominate flexible workplaces of this type. “Coworking” may actually not be the best term to describe the situation anymore, because these “flexible workspaces” are less about cooperation than simply about the availability of workplaces let on flexible terms and on short notice.

The section below will briefly profile three operating types that differ considerably in key aspects.

Business Centres

“Business centres” represent the classic type of flexible workspaces. They have existed since the 1980s and therefore counts among the established players on the office real estate market. Being professionally operated, their claim to fame is to offer an office management just as professional. The main types of units let in them are private offices and bullpens, in either case preserving the privacy of the resident companies.

Coworking Spaces

Coworking spaces in the original sense are a recent addition to global office real estate markets. The first of these were opened in the Northern California area often referred to as “Silicon Valley” and accommodated freelancers from the IT, media and advertising sectors. One of the oldest and best-known places of this type in Germany is “betahaus” in Berlin’s Kreuzberg district. Here, young creative media professionals, mostly start-ups, work in so-called “open spaces.” Most of these consist of a large room fitted out with a number of desks. Workplaces are flexibly assigned according to the “hot desk” principle whereas dedicated workspaces are the exception. Common areas are intended to encourage the networking and collaborating among the resident firms and freelancers. The concept is strongly defined by its community character.

Hybrid Models

Due to the coworking trend and the persistently strong demand for flexible office units, the first hybrid models began to emerge just years after the rollout of coworking spaces. These models adapt the operator concepts of business centres for their purposes and combine them with the charm of the original coworking spaces. This means that, in addition to small open spaces, the units offered represent mainly private offices and bullpens that give even established companies the privacy they need. Common-part areas and organised activities also count among the amenities available to members. The best-known hybrid models currently on the market include WeWork, Rent24 and Design Offices as well as HQ, a Regus spin-off.

Berlin’s office real estate market is to a large extent defined by said hybrid models as a result of the tremendous boom they have experienced in recent years and due to the extremely strong demand for space. The fact is reflected in Berlin’s office take-up figures.

What Makes Berlin the #2 in Europe

Several developments have interacted in Berlin over the past years: the economic upturn in general, the intensifying digitisation, and a societal transformation that has created new living and working formats. As these neatly dovetail with the image of a cosmopolitan and affordable city, Berlin has evolved into the second-largest European location for “flexible workspaces.” While London is the one place in Europe with yet more office accommodation of this type, the German capital is now home to more than 100 venues that permit flexible working arrangements.

This is not least explained by the rise of digital companies. Digital companies play a more dominant role here than in any other German city. During the past five years, companies of this type accounted for more than a quarter of the annual office take-up in Berlin on average. A slowdown of the trend is not to be expected because its appeal penetrates deeply into other economic sectors.

For the same reason, the strong correlation between digital players and flexible workspace seemed to soften in 2018. Flexible office accommodation has become increasingly relevant for established companies as well. A case in point is the Berliner Sparkasse savings bank who commissioned the market report: As an established financial institution, it rented flexible workspace for the purpose of supplementing its conventional working environment with flexible options.

Digital companies have radically different preferences with respect to location and work environment. They generally prefer urban settings in residential quarters, remote from classic office locations. Which is what makes coworking spaces so important. Today, flexible workspaces already account for around 1.2 % of Berlin’s total office stock. Cities in the United States and London show the way forward: Here, providers of flexible workplaces claim as much as 4 % of the total office stock already. That Berlin could he heading in the same direction is by all means a realistic outlook.

Conclusion: Virtually No Reason to Doubt Prospects for Continued Growth

In all likelihood, providers of flexible workspaces will keep gaining in significance, especially on Berlin’s office market. The extremely low vacancy rate—of all things—is currently the only obstacle to even faster growth in floor area of this format. After all, the shortage of accommodation is the very reason prompting the run on this alternative.

The shortage of space will probably make flexible workspaces an integral component in the property strategy of major companies in the short and medium term. Professional operators of flexible office units are inversely drawn to central downtown locations in geographic proximity to major companies but also to the truly trendy quarters.

On top of that, flexible workspaces represent an attractive business model. We are convinced that, going forward, other players will want to buy into this market, among them real estate investors, hotel and gastronomy businesses, the way St. Oberholz, for instance, has already done in Berlin. The threshold for entering this market is extremely low, and they already own the necessary floor space. Meanwhile, the leading providers of hybrid workspaces, such as WeWork and Rent24, also benefit from positive economies of scale. In addition to the major social networks that these operators maintain, occupiers often have the use of locations anywhere in the world – which is quite an advantage for digital nomads and internationally operating professionals.

Minor market shake-outs should not be ruled out, especially not those triggered by tweaks in the macro-level parameters. However, these would barely affect large-scale floor space providers, nor would they drive small-scale providers of flexible workspace out of business – least of all if they are characterised by a high degree of specialisation. So, the ascent of flexible office providers seems more or less unstoppable because they snugly fit the latest technological and societal transformation. The flexible workspace phenomenon complements Berlin’s office real estate market and has initiated a sustainable transformation.

Note: You can download the full-length Market Report 01/2019 “Hip – Hipper – Coworking”.

Contact person: Alexander Fieback,Project Manager Office Market Berlin, fieback [at] bulwiengesa.de