Lifestyle Fads Generate Tailwind in Food Retailing

Lifestyle Fads Generate Tailwind in Food Retailing

The growth in the food retail trade continues unchecked. Even before the hype surrounding the Beyond-Meat burger set in, it became quite obvious: Retailers and operators engage in pinpoint quests for innovation in order to keep their consumers happy. For the 14th Retail Real Estate Report of Hahn Group, we analysed the latest developments in major retail sectors.

The current growth in the food retail trade is increasingly fuelled by the quality of higher-end products, the persistent trend toward organic and sustainably produced and/or fairly traded food, vegan and regional products as well as the steady expansion of the convenience segment. In response, many retail companies have lately picked up on related issues such as animal welfare, animal-friendly fish-farming, and certified food, and taken account of them in their product range policies. In addition, food retailers of regional products are gradually taking over centre stage.

The organic segment has also expanded its sales and market share, and has done so both in grocery and drugs retailing. Unsurprisingly, food market and drugstore operators have responded by steadily expanding their organic assortment. In order to set themselves apart from the product ranges of competitors and to hone their own profile, major food retailers and drugstore chains are engaged in a pinpoint search for new products or innovation in general. One popular strategy in this context is the early market introduction of products made by promising start-ups. A prominent recent example is the Lidl discount supermarket chain, which started stocking Beyond Meat veggie burgers imported from the United States. Many German innovations are successfully marketed along the same lines.

e-Commerce has (so far) Remained Insignificant

The online sales of groceries/gourmet foods and toiletry products continues to play but a subordinate role. According to the Online Monitor of the HDE German Retail Federation, the online share in the foods/gourmet foods segment registered an increase to just 1 % in 2018. In the segment of toiletry products, the growth was even slower. Here, the online share equals 1.5 %.

But although online retailing in this sector is barely growing, operators like dm, ROSSMANN, REWE and EDEKA are busy expanding their online footprint. And they are pursuing these efforts regardless of the fact that the operation of most online channels fails to cover their costs. Drugstore operator Müller is thinking about offering direct deliveries as well and to supplement its existing Click & Collect system. Globus is reportedly wrestling with IT issues that have caused the cooperation with the delivery service Food to be delayed even further, but the online business is to be stepped up regardless.

Focus on Sustainability and Environmental Friendliness

Current focal aspects in the food retail trade include sustainability, the avoidance of plastic waste and environmental friendliness, and it should be added that these issues present themselves in an unexpected complexity. The trend is to some extent the direct response of the retail sector to the highly publicised Fridays-for-Future rallies. As a consequence to the media coverage, customer demand for resource-conserving product categories has increased. Virtually all retailers have made it their business to either reduce or entirely avoid packaging, most notably plastic waste. The approaches taken to implement this goal differ from one retailer to the next. Particularly the recyclability and the use of recyclables in product packaging are gaining increasingly in importance. Aside from the environmental aspects, of course, financial incentives under the new Article 21 of the German Packaging Act (VerpackG), which promotes the use of recyclable packaging, also come into play. Retailers are increasingly aware of their influence, and display a growing degree of responsibility. For instance, retail multiples like Lidl, REWE, ALDI or Netto are already pondering the option to discontinue sales of plastic single-use products altogether, before the new EU regulation banning many disposable plastic items even enters into force. Lidl proactively entered the recycling business by acquiring the Tönsmeier Group recycling company, and it is not the only company that decided to play an active role.

Mobile Phone Services Up and Coming

App-controlled loyalty systems as well as smartphone pay options are generally held in high esteem among food retailers, and will be successively expanded in the coming years. Globus, for instance, launched its own app that doubles as digital customer card. Moreover, Globus introduced the option to use your phone app to check out, thereby expanding its pioneering role in mobile payment. REWE is closing in steadily, offering the same kind of service in more and more of its outlets. By contrast, Lidl is focusing on the smartphone-based customer loyalty program Lidl Plus, but offers it only in 250 outlets so far. The drugstore multiples “dm” and ROSSMANN follow similar models in customer communication and increasingly offer specials and services via their apps.

Business Type Drugstore and Hypermarkets Expanding

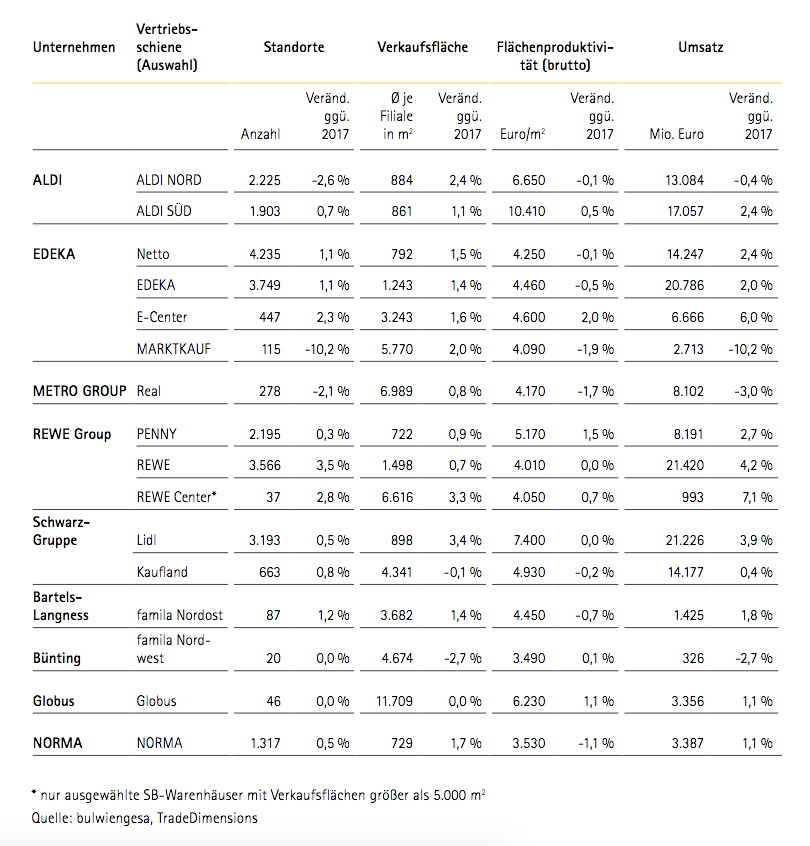

Year on year, the number of grocery stores and drugstores in Germany remained stable at nearly 42,000 outlets (ten outlets less than the previous year). While the growth of drugstores and hypermarkets continues, the number of supermarkets and superstores has declined. The number of discounters has flatlined or dropped marginally. The trend among full-line grocery stores continues to gravitate toward large-scale hypermarkets. In 2018, it was the operating type scoring the fastest growth among the grocery retail formats with an increase by 89 outlets. This reflects primarily the sound development of REWE and EDEKA markets, which keep expanding briskly and opening up new markets or expanding existing outlets to the size of hypermarkets. As a result, the sales area share of this business type went up further to now 25.8 percent while total sales also followed an upward trend and gained around 2.1 percent since 2017.

Contact person: Dr. Joseph Frechen, Head of Branch Hamburg and Division Head Retail at bulwiengesa, frechen [at] bulwiengesa.de