Fast Growth in Office Projects

Fast Growth in Office Projects

Our 2019 Property Developer Survey will not be published until early April, but the key findings are already in. Yesterday, they were presented at an online press conference.

For the fourth time, we presented the “BFW Neubauradar” survey on building activity together with the BFW Federal Association of Independent Property and Housing Companies, as well as the bulwiengesa Property Developer Survey. The findings of the poll and of our property developer survey clearly match – the number of flats built in Germany’s major cities is far too low, whereas the number of office projects is growing fast.

Here are the findings of the 2019 Property Developer Survey for Germany’s Class A cities in detail:

- The property developer market in the Class A cities has resumed its growth – gaining 5.3 %

- Office accommodation is growing at a record speed – of 23 %

- Further slowdown in housing construction

- Concerns about overcapacities in the hotel segment

Feel free to watch the video of the online press conference of 21 March 2019 (German language):

Following a decline the previous year, property developments are growing again, by floor area. Trading development projects—meaning the classic type of property developments intended for sale—grew by 5.3 % to a total volume of 28.4 million sqm across all seven Class A cities. At first glance, things seem to be back on track, and yet the causes underlying the recent development are seriously different from what they used to be.

Residential Segment Continues to Slow, While Office Segment Ascends to Record High

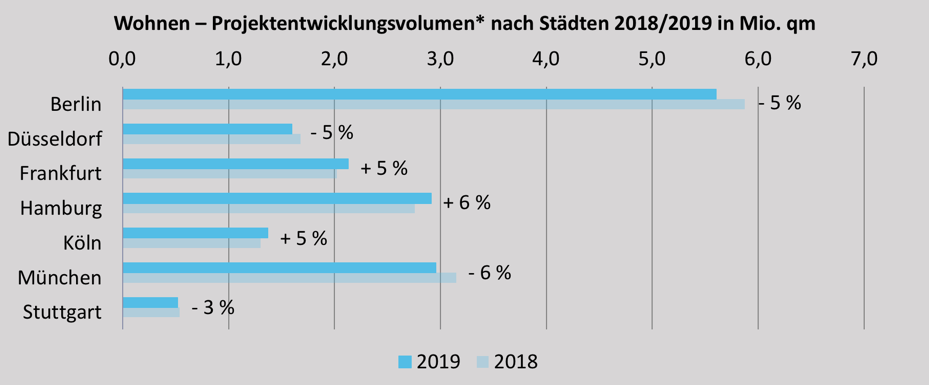

For one thing, the project area total in the residential segment declined by another -1.6 %. The pace of the downward trend has therefore slowed since the previous survey year. But the trend as such points in the same direction, confirming the obvious: The number of residential developments in the “Big Seven” cities is decreasing steadily.

Especially in Berlin, many seem to have lost their appetite for building homes: Unlike past survey years that recorded solely growth in floor area, the prior and current survey years found that the project areas in the residential segment had declined by 4.6 % (-270,000 sqm). Drops were also reported from Munich, Düsseldorf and Stuttgart. But there are also cities with growth in the residential segment. Hamburg topped the list with an increase by 154,000 sqm or 5.6 %. Overall, however, the increases here and there do not suffice to make up for the decreases elsewhere. Neither is the picture brightened by a look at future completions: The floor space in planning accounts for far less than 50 % on most markets and has plummeted—by more than 60 %—year on year.

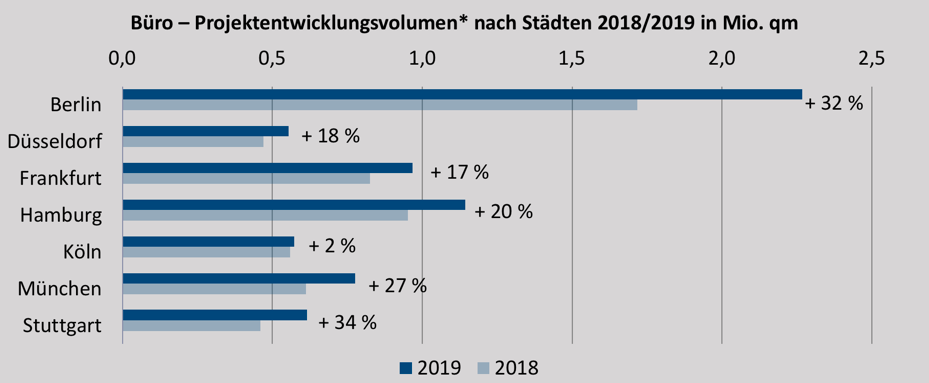

The situation in the office segment is completely different. After years of shrinking floor areas under development, the project areas increased for the third time in a row, this time by a tidy 23 %. While all of the Class A cities are reporting growth, the pace is much faster in some cities than in others, amounting to 32 % or 550,000 sqm in Berlin, for instance. The growth is driven mainly by accommodation still under development or in planning.

It does not even take the extreme example of Berlin with its unchecked decline in residential developments and the enormous growth in the office segment to show that the housing policy in Germany’s major cities influences the investment behaviour and steers it in a somewhat wrong direction. More and more housing developers prefer to develop office schemes, which—even if it does not ease the strain on the housing market—cushions the office vacancy situation that used to paralyse some markets. But from a social angle, the supply of new-build flats for the middle class is evidently drying up. Only the wealthy and the poor are benefiting from new-build housing construction. For the majority in between, the absence of much needed concepts is ever more keenly felt.

Property Developers Have Sound Reasons for Favouring Office Projects

That property developers prefer office projects is due to the low vacancy rates in the large office markets and the rental uplift of recent years. Today, it has become a common phenomenon on some markets to see units pre-let as early as the planning and construction phase. Moreover, office real estate remains a popular investment objective. It is, after all, a segment with robust fundamentals and benefits from “special conditions” such as being sales tax exempt and less tightly regulated than the residential segment – ample reasons for property developers to move ahead. At present, it is not at all uncommon for office projects to be launched on speculation.

This contrasts with the situation in the residential segment, where prices, while remaining high, have reached the limit of what is acceptable to end customers, and this is true particularly in the higher-end part-ownership market. Stiff land prices combined with elevated building and planning costs and ever longer planning periods cause contemplated developments to reach the limit of their profitability. There is no shortage of demand in any of the seven Class A cities, regardless of the price segment. Trying to find a way around the high land prices at least, some property developers have long gravitated toward smaller markets. There, you will find opportunities to build at prices in line with demand and turn a profit still, especially on the part-ownership market.

About the Property Developer Survey

For the thirteenth time, bulwiengesa examined the property development markets in Germany’s “Big Seven” cities, these being Berlin, Cologne, Düsseldorf, Frankfurt am Main, Hamburg, Munich and Stuttgart. Using the basis of roughly 5,000 individual projects (thereof around 3,200 trading development projects, available as Excel list), bulwiengesa analysed the structure and volume of the property developer market and derived drilldown assessments for each city. The survey focuses on the use types office, residential, retail and hotel. It uses extensive project lists to provide a detailed market overview of the various players and their projects.

Here are some snapshots from the press conference (and we would like to seize the opportunity to thank our partner BFW once more!)

Note: The survey was published in early April, using charts to visualise the detailed findings on cities and segments.

Selected findings on the retail and hotel segments and on the property developer ranking are already available in the form of an exhaustive press release (German) on our homepage. There, you will also find the order form (German) for purchasing copies of the survey or of the city reports.

Contact person: Ellen Heinrich, Project Manager at bulwiengesa, heinrich [at] bulwiengesa.de