Signals For a Slump in New Construction

Signals For a Slump in New Construction

Within ten years, project developers have increased their space in the seven class A cities by around 30 percent - not enough to meet the demand for apartments and offices. And now our study "Real Estate Developers 2020" shows: Even before the Corona crisis, the total volume had already fallen significantly. Here are the most important results.

For the 14th time we have examined the market for project developments in the seven German class A cities. To do this, we analyzed over 5,000 individual projects and evaluated them. We examined the uses of office, living, retail and hotel. A detailed market overview of the players and their projects is provided on the basis of extensive project lists.

Weak Growth in the Seven Class A Cities

Within ten years, between 2010 and 2020, the classical project developers, who build for sale, have increased their building volume in the seven German class A cities by around 30 percent. Nevertheless, this volume was not sufficient to meet both residential and office demand.

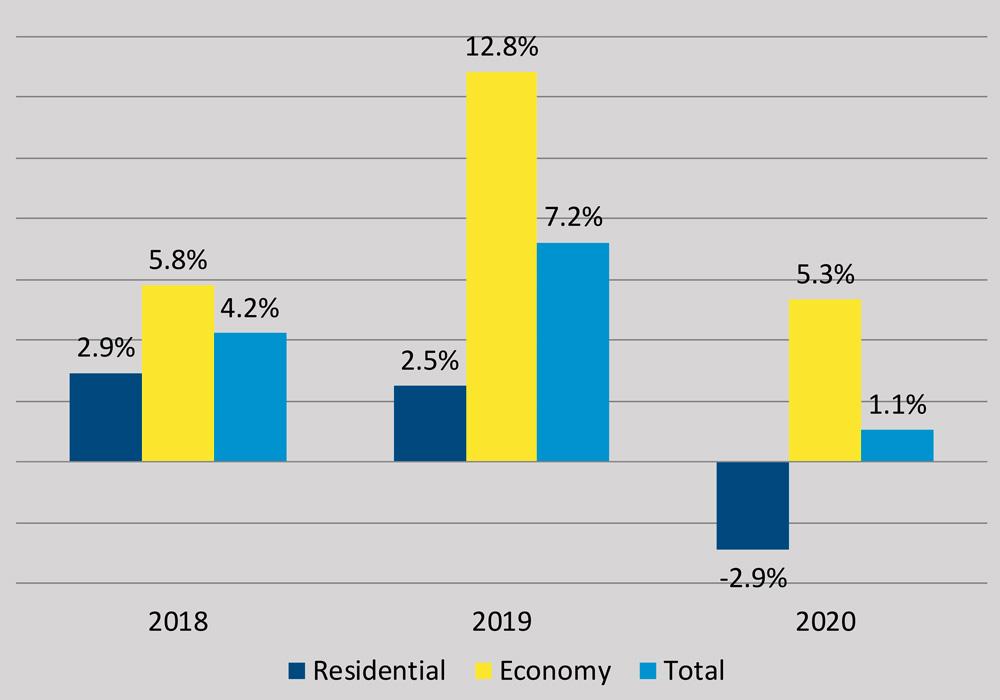

Currently the situation is worsening: whereas in 2017 the market for project developments in the seven class A cities grew by 4.2 percent, and 2018 showed a growth of a whopping 7.2 percent, in the current study year 2020 project volume is growing only weakly at 1.1 percent (approx. + 500,000 sqm).

In particular project developments for residential property in the seven class A cities are declining by 2.9 percent - even though property owners such as municipal housing companies are continuing to build heavily. At the same time, there has also been a significant decline in the growth of commercial property.

The project developer market is clearly drifting apart also in terms of its players: On the one side, the investor developments (building for own use or to hold), are still growing by 5.4 percent. On the other side, the trading developments (building for sale) has declined for the first time since the series of studies began 14 years ago. Compared to the previous year, 1.9 percent less space was developed for resale. The trader developers are withdrawing.

The 2020 study analyses the project development volume (in square meters) of trading and investor development together. Investor Developments have been surveyed for the study since 2016.

Less Residential

For trader developers, the residential segment in the seven class A cities continues to lose considerable appeal, as already shown in the chart of the month for April. For these classic project developers, the project volumes both in 2018 and 2019 were already slightly but consistently declining. Now this trend has become extremely strong with a very significant -1.16 million sqm or -6.8 percent. Even if the project volumes of the investor developers, such as the municipal housing companies, which continue to grow in the class A cities, are also considered, there is still a significant decline in the residential market of 719,000 sqm or -2.9 percent. This is the first decline in residential project volume since the first Real Estate Developers 14 years ago.

It should be noted, however, that this trend only applies to the seven class A cities, which are clearly defined with their municipality borders. However, this development should not be equated with a nationwide trend, especially in the residential segment. Residential project developers remain loyal to the German housing market, but are much less active with residential projects directly within the class A cities. Their activity is shifting to the surrounding communities and the smaller class B and C cities.

Slowed Boom in Commercial Real Estate

Since 2017, project developers prefer to plan and develop commercial properties, especially offices. The players have thus been reacting to the very good general conditions that have existed for years: high and increasing demand for office space in markets with low to very low vacancy rates. This also applies to the current study survey. Pre-letting of office space in the construction or even planning phase was not a problem on the survey date (31 December 2019).

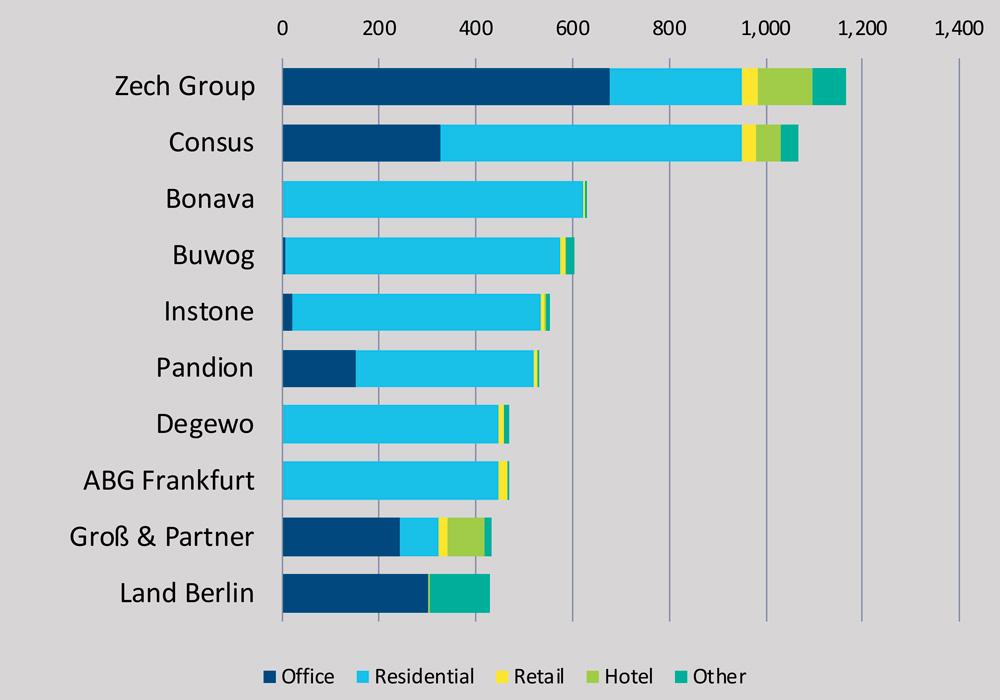

Across all class A cities, growth of office project volume in 2019 is 16.0 percent. Berlin in particular is contributing to this. At 1.04 million sqm (+24.2 percent), this is an outstandingly high figure, even though the capital city was unable to match the extremely strong growth in volume of the past three years. In general, Berlin is decoupling itself from the overall development: While the total project development volume is stable or declining in almost all other class A cities, it continues to grow in Berlin.

From now on, however, Berlin's success is likely to be most at risk. Retail, hotel and office properties in particular will now react very sensitively to the recession.

Retail and Hotel Sector Facing Enormous Upheavals

After a short breather in the previous year with stable project spaces, the retail trade segment is still on the retreat in the study year 2020. The Corona crisis was not needed for the slump: space volumes collapsed by 267,000 sqm or -12.1 percent. This shows the continuing strong structural change in this segment. It is in the retail segment, where the share of planned projects in total projects is the lowest.

The hotel segment lost momentum in terms of project development volume as of 31 December 2019. Only 70,000 sqm more project volume than in 2019 could be measured on the overall market. This is small compared to previous years (287,000 and 513,000 sqm respectively). The market conditions for the hotel segment have already clouded over in 2019 in some markets. In some cases, oversupply was already feared at that time. In general, however, at the end of the survey this segment still offered some potential for the current study and continued to arouse the interest of both operators and investors and thus also of project developers.

Video of the online press conference (German language)

On 31 March 2020, Andreas Schulten, General Representative at bulwiengesa, presented the most important results of the Real Estate Developers 2020 in an online press conference. We thank our study partner BFW Bundesverband Freier Immobilien- und Wohnungsunternehmen e.V. who hosted the video on their channel.

Note: Information on ordering the Real Estate Developers 2020 can be found on our website.

Contact person: Ellen Heinrich, project manager, heinrich [at] bulwiengesa.de