The Mortgage Lending Value – Stabilising Anchor or Deadweight?

The Mortgage Lending Value – Stabilising Anchor or Deadweight?

The mortgage lending value is the basis for the security of mortgage bonds. As is well known, reliance on this model helped Germany get through the financial crisis more or less unscathed. Yet the rigid limits do not represent an adequate response to the widening gap between fair market value and mortgage lending value. Or do they?

Over the past years, the mortgage bond has proven a stabilising anchor on the German real estate market. Even from the upheavals of the sub-prime crisis and the Lehman bankruptcy it triggered—seen by many as a litmus test for asset safety—the mortgage bond emerged intact. So, there is every reason to call it a successful model. In the context, the German Mortgage Lending Value Ordinance (BelWertV) plays a key role because the mortgage lending value serves as basis for the perceived safety of mortgage bonds.

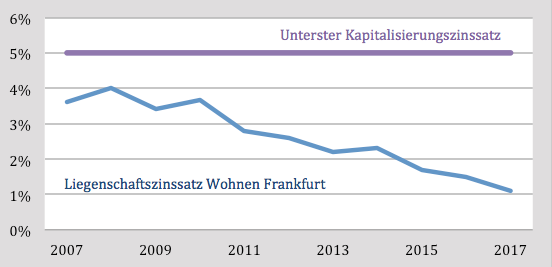

At this time, however, the question presents itself whether the security concept is not perhaps exaggerated and standing in the way of affordable financing. If, for instance, you examine the property yields in sought-after metropolitan locations in a long-term series you will quickly note that property yields were considerably lower than the 5 % prescribed as capitalisation rate of residential real estate by the Mortgage Lending Value Ordinance even during the upheavals on the capital market. They have seriously declined in the time since, and property yields in German conurbations are unlikely to go back up anywhere near the level of 5 % in the foreseeable future.

For example, property yields for high-end residential real estate in Frankfurt, which stood at 4 % in 2007, is now quoted at 1 % or less, as the chart shows.

The widening gap between reality (market) and risk willingness (mortgage lending value) is becoming increasingly hard to explain for property surveyors – which has nothing to do with their own competence and everything to do with the dubious purpose of the rigid limits set by the Mortgage Lending Value Ordinance.

Financing Costs on the Rise

For bank customers, high market values and low mortgage lending values imply elevated financing costs. As the relative share of primary financing components that are eligible as cover assets declines (60 % of the mortgage lending value), the total funding costs go up. This also has ramifications for the rent rate demanded to ensure that investors earn at least some returns, however low their target returns may be.

But the debate on the subject of low-priced construction and affordable housing does not even discuss how sensible the rigid limits of the Mortgage Lending Value Ordinance are. It almost seems as if the mortgage lending value enjoys a sacrosanct status and as if no reform is wanted.

But let us take an unbiased approach to the subject and start our discussion of it by taking a closer look at the quality standard of the mortgage lending value. Article 16, German Mortgage Bond Act (PfandBG), elaborates: “The mortgage lending value may not exceed the value obtained through a prudent assessment of the future marketability of a property while taking the sustainable long-term characteristics of the property, normal regional market conditions as well as current and possible other uses into account.”

The mortgage lending value thus defines a minimum value that an orderly realisation of a given property should return through the selling price even during market cycles of low demand. When looking back at past market cycles—the most recent “credit crunch” crisis expressly included—it is safe to say that the achievable market values still substantially exceeded the appraised mortgage lending values. The exceptional market of 2009 does not even represent a normal fluctuation in market activity but is understood to have been a one-off market shift that is not expected to repeat itself in the foreseeable future. And yet the interest rates determined during this period of time remained below the minimum capitalisation rates of the Mortgage Lending Value Ordinance.

The question that presents itself therefore is this: Is it possible to adjust the Mortgage Lending Value Ordinance to the long-term market conditions without compromising the security standard? Or would it be even harmful to have this discussion?

Join the debate!

We, the team of the valuation company bulwiengesa appraisal, would love to know your opinion on the subject! Send us your comment and—assuming your consent—we may include your contribution in a later blog post later on.

Contact person: Sven Carstensen, Managing Director of bulwiengesa appraisal GmbH, carstensen [at] bulwiengesa-appraisal.de