April: Residential Project Developers Bid Farewell to Class A Cities

April: Residential Project Developers Bid Farewell to Class A Cities

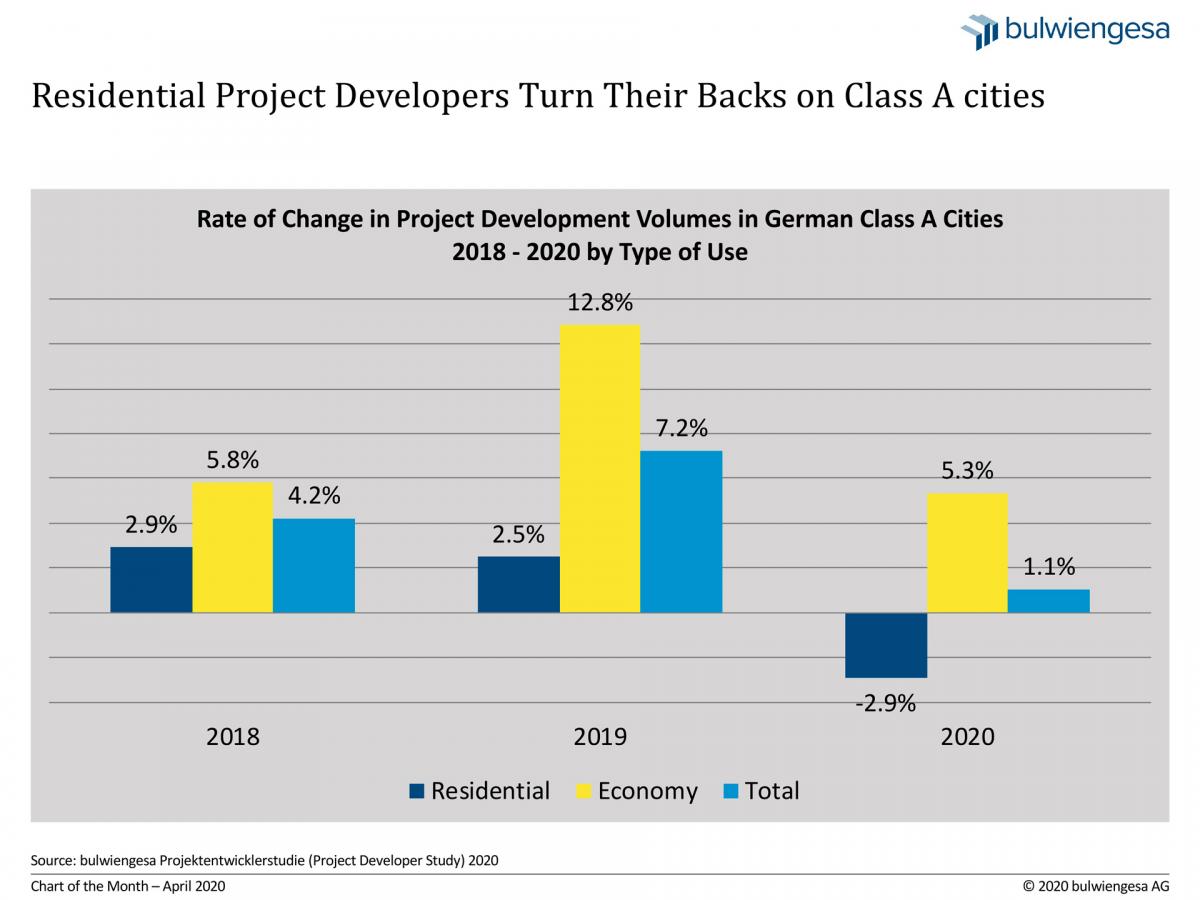

The Project Developer Study 2020 shows: for the first time, residential property developments in the seven class A cities are declining. At the same time, growth in commercial real estate has also been significantly dampened

The chart of the 2020 project developer study clearly shows: For project developers, the residential segment in the seven class A cities (Berlin, Frankfurt, Hamburg, Munich, Cologne, Düsseldorf, Munich) continues to lose a great deal of its attractiveness, most noticeably in Munich and Cologne. In 2018 and 2019, the space available to classic project developers (trading developments) was already consistently declining; now this trend has become extremely strong with a very significant -1.16 million sqm or -6.8 percent. The investor developers, i.e. the municipal and private housing stock owners, were able to compensate for this well with their projects at that time. Now, this compensation is no longer sufficient and the housing market has declined by a significant 719,000 sqm or -2.9 percent. This is the first decline in residential construction in the seven class A cities since the first project developer study 14 years ago.

It should not be overlooked, however, that this trend only applies to the seven class A cities. Especially in the residential segment, this development cannot be equated with a nationwide trend. Residential project developers continue to remain loyal to the German housing market; they are only much less active with residential projects directly in one of the class A cities.

An anticipation of the Project Developer Study to be published at the beginning of April shows that traditionally the list of the ten largest project developers in the residential segment is headed by the large trader developers, who this time account for 59 percent of the project area. In the meantime, locally or regionally active portfolio developers such as ABG Frankfurt or Berlin-based Degewo are also visible here. Overall, however, the German market for project developments is small-scale – the top 10 project developers have a market share of just 13 percent (across all segments).

With the 2020 study, the project development volume of trading developments (developments for sale) and investor development projects (developments for own portfolio) is analysed together for the first time. Investor development projects have already been collected for the study since 2016.

Note: The complete 2020 project development study will be available from 8 April (information on ordering in German language).

Contact person: Ellen Heinrich, project manager at bulwiengesa, heinrich [at] bulwiengesa.de