November: A Look at Germany’s Logistics Regions

November: A Look at Germany’s Logistics Regions

The shortage in available land plots in some logistics regions is causing the keen demand for space to go unmet. Our new mathematical model captures the regional demand across Germany – arriving at an annual total of 6.5 million square metres. The good news being: There are alternatives on the peripheries.

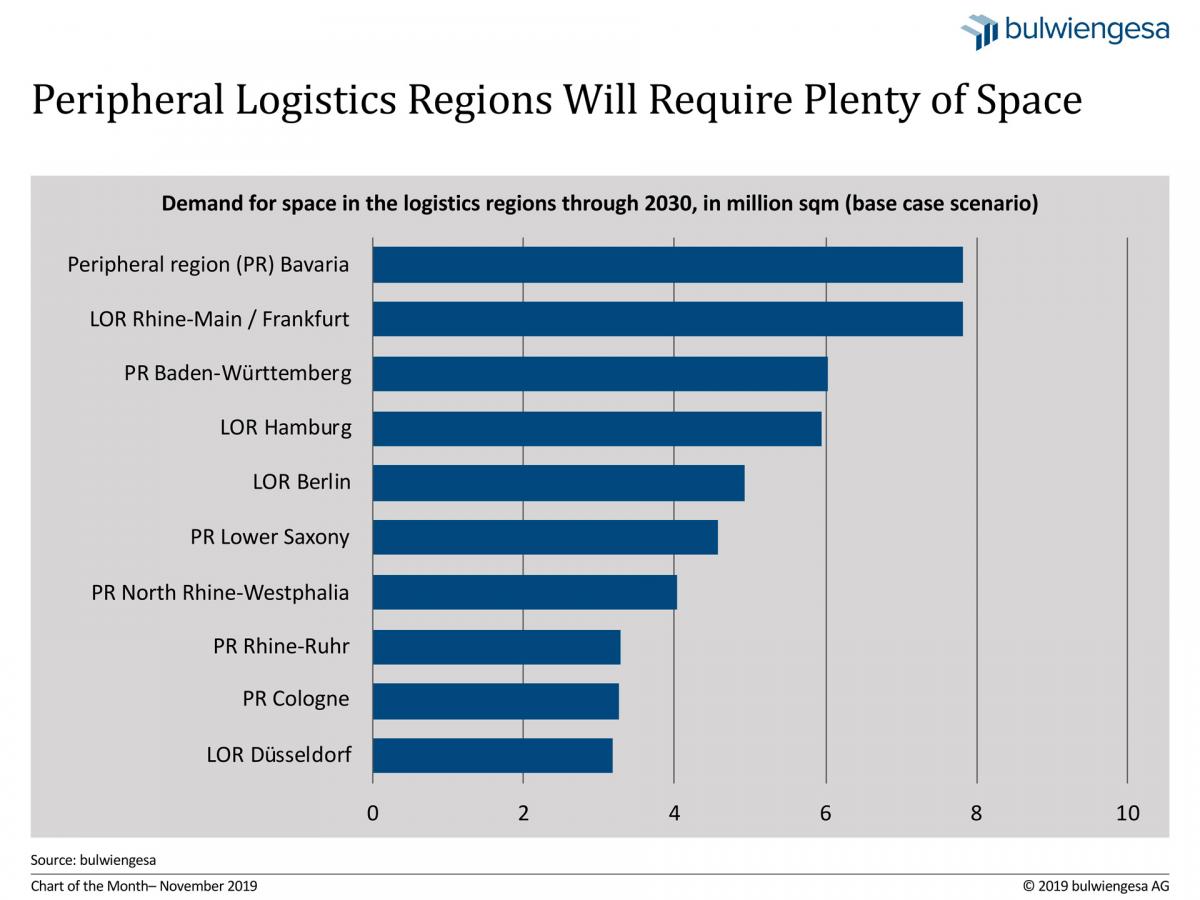

The survey “Logistics and Real Estate 2019” that was published in October shows: While the development of logistics facilities continues to be centred in Germany’s established logistics regions, it gravitates more and more toward the peripheries of these regions. The Chart of the Month depicts the ten regions expected to have the highest additional demand for accommodation in future. The term “peripheral regions” (PR) denotes regions beyond the major cities or established logistics regions (LOR). But lately, most occupiers and tenants have started preferring locations near conurbations, and the same is true for property developers and investors.

For the first time, the mathematical model “GI-Flex lite” that bulwiengesa developed was used to capture the nationwide demand for logistics accommodation. The outcome reveals a large gap: The identified annual demand of 6.5 to 7.0 million sqm of additional logistics space in Germany is at odds with the total of around 5 million sqm in current completions. The situation is gradually producing a bottleneck.

The calculation is done, simply put, by matching the job growth relevant to logistics with the demand for space – because floor space requirements rise in proportion to the number of people hired. However, the future ratio of floor space per employee in logistics properties may change as a result of automation, digitisation, or reduced storage requirements. With that in mind, we calculated another two scenarios in addition to the base case scenario presented here – one with increased and one with reduced floor space consumption, respectively. You will find either in the survey (see page 41).

Demand for Accommodation is Strongest in LOR Rhine-Main/Frankfurt and in the Periphery of Bavaria, Slowest in Bad Hersfeld

The identifiable extra demand for accommodation between now and 2030 is particularly high in some peripheral regions of the larger states, such as Baden-Württemberg, Lower Saxony and North Rhine-Westphalia. Unlike in the established logistics regions of the metropolises Hamburg and Berlin, where demand for additional logistics facilities is also extremely high, these states have far more options for zoning the required development land.

The Rhine-Main/Frankfurt logistics region with its very strong requirements has stood out in recent years as the region with the largest regional completions volume – which means inversely that the keen demand here has so far been reflected in an above-average level of building activities. The same demand level of around 7.8 million sqm in additional logistics accommodation between now and 2030 is projected for the peripheral region of the state of Bavaria.

Overall, the demand volumes were determined in 41 regions for the purpose of the survey. The keen demand in the ten regions covered by the chart should not distract from the fact that many regions at the bottom of the list (see survey, p. 41) require smaller volumes of additional floor area. For instance, the logistics regions Bad Hersfeld, Aachen, Magdeburg or Koblenz will require virtually no additional logistics space before 2030. The same is true of Saarland, where the demand for space was found to be negligible both in the Saarbrücken logistics region and in the peripheral region. But this does not necessarily imply that these logistics regions have been “left behind.” Demand is low whenever few logistics-relevant jobs are added; in regions of this type, economic forecasts assume that the logistics business sector is unlikely to see a serious growth in social security-covered jobs. Then again: If a player like Amazon suddenly moves in, the way it happened in Magdeburg, the predictions are somewhat compromised despite an accurate forecast model.

The demand for logistics facilities will remain high in future, as the demand forecast of the “GI-Flex lite” model illustrates. It will become increasingly difficult to provide the supply that is needed to meet this demand. The situation in many places already suggests that this discrepancy between hypothetical need and actual completions volumes is here to stay. To cover demand, both the building activities and the availability of suitable land would have to increase substantially. In addition, there are other alternatives—also discussed in the survey—for relieving the shortage of accommodation, e.g. through infill densification, brownfield development, by restructuring existing business areas, by merging plots or by building multi-storey assets.

Contact person: Tobias Kassner, Head of Division Industrial and Logistics Real Estate at bulwiengesa, kassner [at] bulwiengesa.de