Desperately Seeking Property Investment Opportunities

Desperately Seeking Property Investment Opportunities

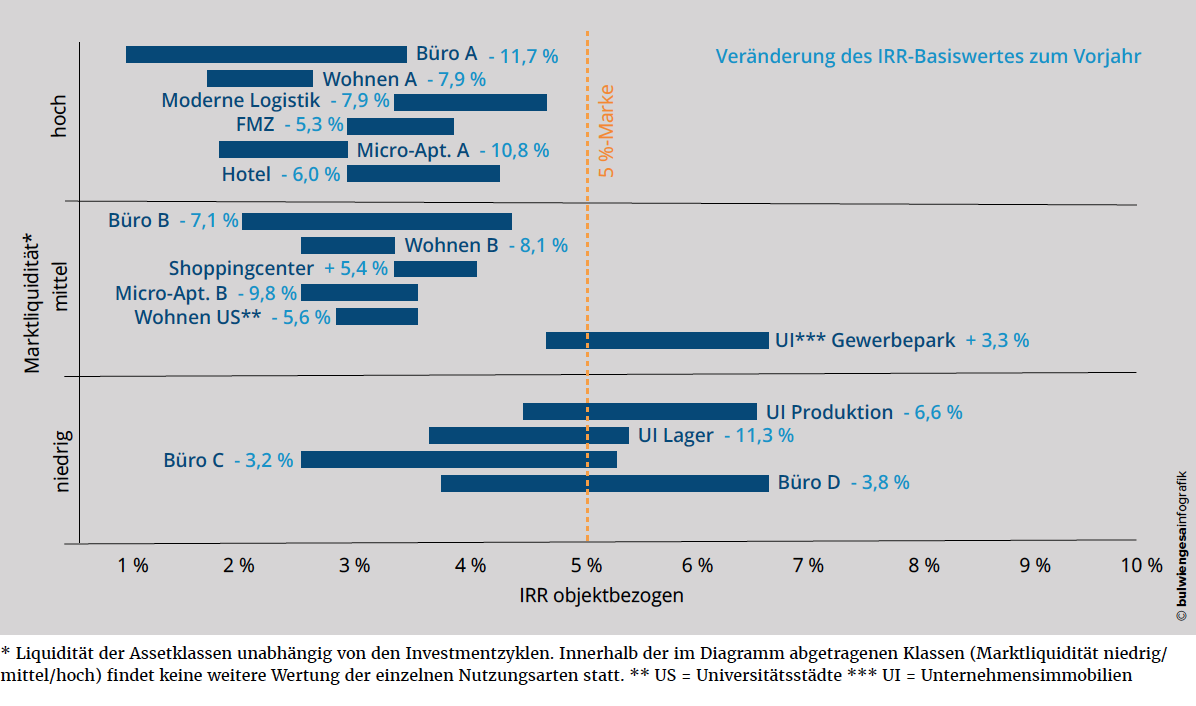

The fifth 5 % survey shows: Rates of return (IRR) took another nosedive in every asset class except shopping centres. Demand for German real estate remains as high as ever, even as uncertainty factors are stacking up. Investors accept the steadily declining returns.

With our latest “5 %” survey, we once again analysed the return potential of Germany’s real estate market – kindly supported by the BEITEN BURKHARDT law firm and the TLG Immobilien AG real estate company. Here is our key finding: For the first time, it proved impossible to identify any type of use in the core sector—meaning properties with long leases to good covenants in sustainably good locations—that would pay an IRR of 5.5 % or more. Anyone targeting a 5 % return on investment will keep having to opt for smaller markets and niche segments. But even in these, the range of choices is narrowing. Returns of 5 % or more are achievable only in the office markets of Class D cities as well as with business parks and light manufacturing properties.

Residential Real Estate in Class A Markets Near 2 %

It evidently keeps getting harder to invest profitably in existing residential real estate in the markets of German A- and B-Class cities. The rise in price-to-rent multipliers continues, and so does the price growth. The growth is motivated primarily by the attractive market environment as well as by very strong demand on the investment market.

Like previous years, housing markets in conurbations have clearly followed an upward trend, despite the rent freeze. Residential real estate prices have continued to rise over prior year, albeit at a slowed pace. The achievable yield for core properties in the Class A cities now ranges from 1.6 % to 2.5 % (previous year: 1.9 % to 2.6 %). Even the yield level for residential real estate in Class B markets has kept slipping and is currently between 2.4 % and 3.2 % (previous year: 2.8 % and 3.3 %).

.

For investors, flats in Class A markets offer stable investment opportunities with a very low rate of return. However, regulatory obstacles keep limiting the options for rent reviews. Our recommendation to safety-oriented investors is therefore to pick markets with positive demographic growth and a sustainable economic structure because here the risk of income losses or severe market price fluctuations tends to be negligible. However, it is too early to tell just how far the body politic is willing to take its market interventions. Introducing a rent cap of the sort currently pondered in Berlin could cause tremendous losses in value. Any investment decision should therefore be preceded by an examination of the political environment.

Micro-apartments have long established themselves as an asset class in their own right. Yield rates in this segment have dropped to the same level as regular flats. But whether they share a comparable risk profile is not quite clear yet. It remains to be seen how sensitive the product is in its response to market fluctuations.

Offices in Prime Locations Barely Qualify as Inflation Safeguard – Keen Demand for Non-Core

Demand for core property in Germany’s office sector remains as strong as ever. As a result, the yield compression has persisted. The achievable yield for core properties in the Class A cities now ranges from 0.9 % to 3.3 % (previous year: 1.1 % to 3.5 %). As this spectrum shows, returns on investments in core property could easily drop below the inflation rate of currently around 1.7 %.

Virtually all Class A markets are characterised by a massive pent-up demand that is reflected in low vacancy rates. The achievable rates of return are on a very low level. Many investors continue to hope for rising rent rates and accept, almost desperate, the ever slimmer rates of return.

The situation has prompted investors increasingly to look for non-core properties that come with vacant units and therefore with return potential. However, the excellent performance of the office markets is making it harder and harder to find such products. Even properties and locations exposed to difficulties during normal market cycles benefit from market vacancy rates of less than 2 %. The fact is visibly reflected in the pricing. Many opportunistic players have therefore lost interest in them as investment assets.

But even in Class B markets, return expectations have become rather modest at 3.28 %. The C- and D-Class markets still offer higher rates of return and thus qualify as alternative. Then again, the supply in properties is limited by the small size of these markets. Moreover, returns here cover a wide spectrum. Running in-depth analyses is a must.

Retail Sector: Mounting Unease

Second only to office real estate, retail real estate remains one of the strongest segments on the German real estate investment market. But there is growing scepticism. It is motivated by the poor availability of product and the sense of uncertainty regarding the way forward for retailing as such.

Shopping centres are particularly hard hit by the structural changes in the retail sector. Due to the changed shopping behaviour of German consumers in favour of online offers, investors doubt the sustainability of the rent revenues generated by retail tenants. Once again, shopping centres were the only asset class that showed growing returns, the basic rate being 3.88 %. This could open up opportunities for market experts who seek to invest on a grand scale as standard price tags in this market range from c. 80 to 500 million euros.

Meanwhile, retail warehouses have remained unaffected by the trend. Yield rates continued to harden, and the asset type has now replaced shopping centres as the most attractive core investment product in the retail sector. Its going rate is 3.59 %, down from 4.74 % in 2015. Retail warehouses are deemed to be less exposed to online retailing.

Notwithstanding the ongoing transformation, retail properties will continue to be needed and subject to occupier demand in the medium and long term. Investors should analyse how badly a given retail offer is affected by current shifts in the retail business in order to price in potential alternative uses. In contradistinction to other asset classes, market prices for shopping centres continued to soften.

Keen Interest in Hotels

The options for investing large amounts in the hotel segment are also drying up, and the yield rate here has gone down to around 3.2 % lately. For the time being, though, hotels remain high on the agenda of operators and investors, and it is not a rare thing to see them accept even locations that fail to fully meet the required standards. So, investors should by all means clarify to what extent a sustainable use can be assumed for the duration of the respective leasehold agreement (suitability for alternative use).

Modern Logistics Yields Drop Below 4 %

The change in consumer behaviour is being felt not only in retail real estate. The rise in demand that is driven by online retailing has propelled logistics real estate all the way to the top of investors’ wish list. Demand pressure has seriously pushed down the yield level: Having been close to 5 % as recently as 2015, it slipped below the 4 % mark since and is now at 3.91 %. The fact that demand for logistics facilities remains very high on the occupier side and that the supply in industrial plots is very limited makes it safe to say that yield rates are unlikely to perk up any time soon.

Even basic warehouse properties remain very much in demand. In fact, they are the only type of real estate in the Unternehmensimmobilien (UI) segment that is well below the 5 % mark at 4.26 %. This leaves only light manufacturing properties and business parks, in addition to small office markets, for investors who are looking for investment opportunities in the core segment with more than 5 % in returns. Assets with vacancies or leases about to expire continue to offer chances for a superior performance of up to 10.5 % (IRR). However, properties of this kind tend to require intense management and are therefore suited only for specialists who bring relevant industry know-how and technical expertise to the job. Less complex, by contrast, are the management tasks associable with warehouse properties. Here, rates of return as high as 8.1 % are in the cards.

* IRR = internal rate of return This ratio is used to appraise the profitability of investment opportunities. To this end, a ten-year holding period is assumed.

Note: You are welcome to download the full-length survey.

Contact person: Sven Carstensen, Niederlassungsleiter Berlin bei bulwiengesa, carstensen [at] bulwiengesa.de