Build to own

Build to own

The trend is impossible to overlook: Fewer developments in Germany’s “Big Seven” cities are built to be re-sold—the “classic” approach—while more are destined for the proprietary portfolio upon completion instead. The companies pursuing this approach have sound reasons for doing so.

The market for so-called investor developments is getting ever more important. For one thing, the significance of this market relative to the floor space volume is growing. On the other hand, our clients request related stats and assessments from us with increasing frequency. For example, CA Immo recently commissioned a special analysis on the subject of investor developments from us, and our analysis and ranking included a detailed account of such projects. The survey title translates into “Property Development in German Metropolises: Why Investors Build to Own Now.” Together with CA Immo, we presented our findings to the press in mid-September.

Although we did not begin to study investor developments the same way we examine trading developments in the context of our Property Developer Survey until 2016, the findings are unambiguous: Climbing to 40 %, investor development projects slowly continued to increase their share of the market in 2019 and now claim a considerable chunk of the overall market.

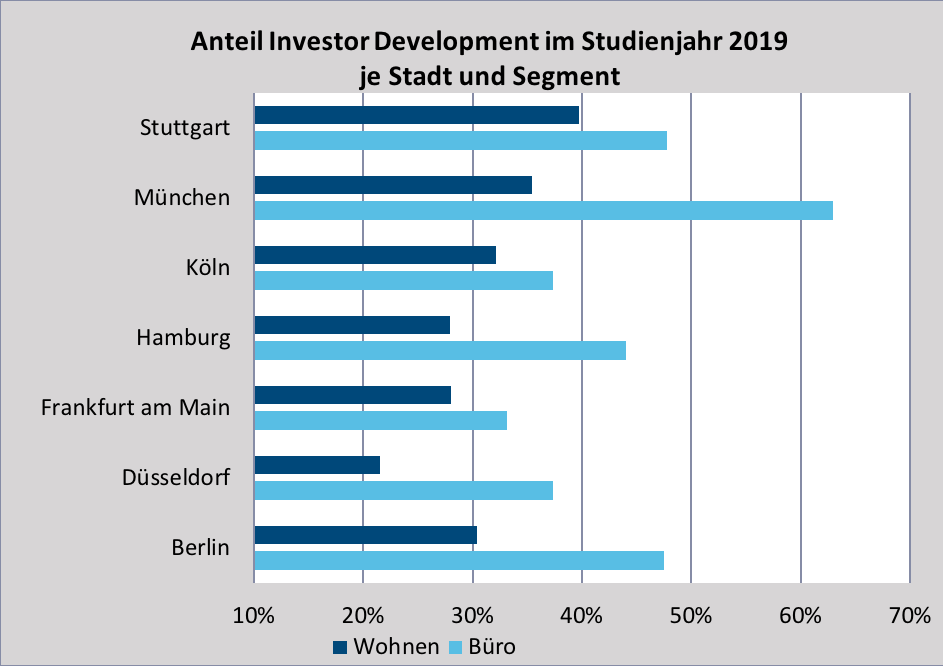

Especially in the commercial segment, investor developments are conspicuously present, boasting a large share. Traditionally, investor development assets had their largest market shares in the logistics sector. Here, the percentages exceed 76 % on average. Yet it was among the much more relevant property developments in the office segment that the share of investor developments went up from 43 % in 2016, the years we first included them in our analysis, to more than 46 % by 2019.

The residential segment shows an analogous trend. The share of investor development project areas rose from just over 20 % in 2016 to more than 30 % by 2019.

There are various reasons to explains this

Even though the figures are limited to the seven Class A cities analysed by the Property Developer Survey, they point to a major trend nonetheless. The development is caused by several factors.

First of all, companies are shifting their strategies: Players who generally used to sell their property developments increasingly retain them in their holdings. As a result, they benefit from the downstream value chain steps of a given property development: the strategic letting, efficient asset management and sustainable ongoing development of the property, and perhaps the optimal tax treatment of the investment, too. Add to this the possibility of benefiting from the presumed appreciation of their properties as a result of rising land prices. Not least, investor developers also benefit from the value preservation associated with the “safe haven” investment of real estate, and need not hunt for acceptable alternative investments.

Secondly, conventional property developers are pulling out of the analysed “Big Seven” cities, or at least out of certain sub-segments, and are thereby clearing the way for investor developers, in a manner of speaking. This is true specifically for the residential segment where conventional developers have long had difficulties finding affordable developable land. Also worth noting about this market is that the politically sought promotion of rent-controlled housing will often provide an extra boost to the share that residential property holders claim in property developments.

Thirdly, property asset holders sometimes have an easier time—at least in the “Big Seven” cities—to exploit building land reserves on plots they own than classic property developers do. The way to do this is through infill densification or by expanding the scale of development projects on site areas already in the property asset holder’s possession. Cases in point include the infill densification of the Platensiedlung housing estate in Frankfurt by ABG Frankfurt, the Allianz Campus in Stuttgart or Tower ONE in Frankfurt by CA Immo.

Still, Classic Property Developers Remain in the Lead

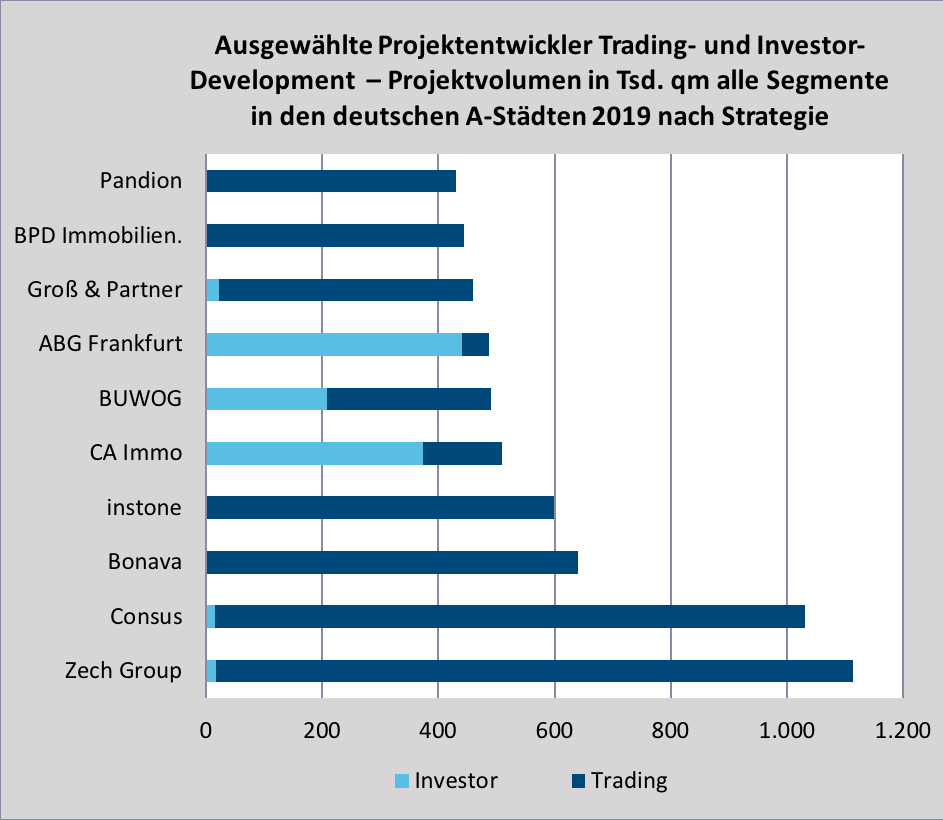

Despite this development, classic property developers remain the key market players with their trading development assets in Germany’s seven Class A cities. A closer look at the lead players across segments and project strategies (trading developments or investor developments) shows that, except for ABG Frankfurt, this is exclusively a private domain. Apart from ABG Frankfurt, the only companies worth mentioning because they prioritise investor development projects are CA Immobilien and BUWOG. In other words, market activities continue to be dominated by the trading development strategy.

Differences in the importance of the investor development market are manifest, by the way, not just among segments but also from one city to the next. In Munich, for instance, it is most notably the office segment that has an above-average share of investor development project areas. In Frankfurt, by contrast, projects of the investor development type play a clearly sub-average role in this segment.

This will remain a fascinating market to watch. What helps us do so is the growing willingness of investor developers, too, to participate in the data exchange for the purposes of bulwiengesa’s Property Developer Survey. This has enabled us to verify around 50 % of the annual project areas associable with the classic trading development strategy. We would like to take this opportunity to thank all participating companies once more.

Contact person: Ellen Heinrich, author of the Property Developer Survey, heinrich [at] bulwiengesa.de