Happy Holidays at the Baltic Seaside

Happy Holidays at the Baltic Seaside

The market for holiday properties has seen upward growth, as the Baltic seaside is highly attractive for many potential buyers. On behalf of PRIMUS Immobilien, we put together a comprehensive portrait of the Baltic seaboard in Mecklenburg-West Pomerania and outlined the investment potential. All holiday trends suggest that the market opportunities will stay as auspicious as they are.

The Baltic seaboard of Mecklenburg-West Pomerania is a holiday destination of long-standing tradition. It was here that Germany’s first seaside resort was built 150 years ago. Bearing the moniker “Berlin’s bathtub” because of its convenient proximity to that city, the Baltic seashore with its diverse leisure and recreational options in combination with a scenic landscape remains highly popular. Inversely, the Baltic seaboard benefits considerably from the brisk growth in jobs and purchasing power in the German capital.

Driven by booming demand for accommodation in Germany and for investment opportunities, the market for holiday properties has developed rather handsomely in recent years. Building activity, transactions and selling prices have all gathered momentum, and the pace will continue to accelerate in response to mega trends that stimulate the trend.

PRIMUS Immobilien AG, the company that commissioned the Market Report, is active as property developer on the Baltic seaboard of Mecklenburg-West Pomerania, most notably in the segment of premium holiday properties.

Trend toward Shorter but More Frequent Trips

Tourism has seen enormous growth in Germany in recent years. The Federal Statistical Office counted a total of nearly 478 million overnight stays in 2018, an increase by more than one fourth over a ten-year period. The figure also marks the ninth consecutive increase in the number of overnight stays as well as a new record level. Roughly four out of five guests are domestic travellers. The average length of stay is currently around 2.6 days per trip. By contrast, holidays on the Baltic seaboard last five to six days. Aside from the fast-growing demand for trade fair and urban tourism, the growth is most conspicuous on the market for wellness- and sports weekends on the seaside or in the mountains. The number of short vacations has increased by more than 50 % in the years since 2003. The shift toward shorter but more frequent trips is a long-run trend. Predictably, the trend has increased the significance of destinations inside Germany that are easy to reach, not least because environmental aspects are taken into consideration.

According to a recent survey that Allianz Global Assistance conducted in 2018, nearly half of the respondents like to take short trips (44.2 %). At the same time, extended domestic holidays are also becoming more attractive and popular. Roughly one in three Germans actually favours longer domestic trips of three or more overnight stays. A poll conducted in 2018 by the BAT Foundation for Future Studies revealed that 52 % of the German respondents now prefer to consider and select domestic destinations over long-distance travel.

Booming Business in the Imperial Spas

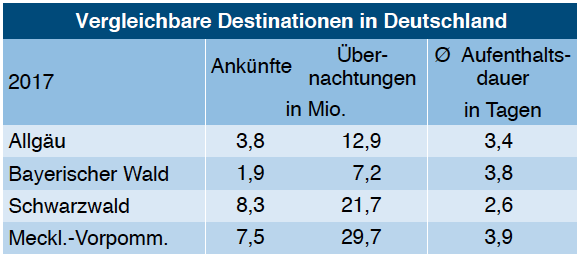

Over the past ten years, the state of Mecklenburg-West Pomerania has registered a very positive trend in the number of inbound tourists (+14.3 %) and overnight stays (+8.2 %). And the key ratios reported from the seaside resorts exceeded the state level average. According to the statistics office of Mecklenburg-West Pomerania, nearly 30 million overnight stays were registered in the state in 2017. The state’s coastal region accounted for three of every four overnight stays. Almost 97 % of the guests come from Germany.

More than one third of all overnight stays in 2017 were booked in hotels, followed by around 4.9 million overnight stays in holiday cottages and holiday flats. Inbound tourists and overnight stays in properties of this type have increased since 2014.

At present, the number of holiday cottages and flats in hospitality operations of more than ten holiday flats adds up to around 54,000 and is back on the rise after a temporary dip in recent years. While the number of larger new-build complexes with more than 100 units is increasing, smaller holiday properties are declining in number. The significance of supplementary service options and leisure attractions is growing; these are easier to set up and finance in larger facilities. Cases in point are assets consisting of holiday flats and hotel rooms, such as the suite hotel of PRIMUS Immobilien AG currently under construction in Ahlbeck. The rent level is comparatively high on the Baltic seaboard. According to BestFewo, annual average rents range from 90 to 100 euros. During the high season, standard rates for premium properties exceed 200 euros per night.

Over the past years, the seaside resorts of Mecklenburg-West Pomerania have generally proven more popular than any other region in the state. Well over half of all holidaymakers on the Baltic seaboard hail from West Germany. The trend in overnight stays has been particularly auspicious in the imperial spas of Ahlbeck, Heringsdorf and Bansin on Usedom, collectively referred to as Heringsdorf since 2005. Tourism key ratios also top the state average in Boltenhagen, Zingst and Kühlungsborn. The trend forecast suggests that the upward momentum is likely to persist in the years to come.

Many Holiday Properties Bought from Inherited Wealth

Aside from the low level of interest rates, the demand for real estate and with it for holiday property is boosted by substantial amounts of capital released through inheritances. The DIW German Institute for Economic Research compiled a survey on behalf of the Hans Böckler Foundation that quotes a total of 400 million euros inherited between 2012 and 2017. These figures are based on the asset total that people over the age of 70 owned in 2012. The majority of heirs is 40 to around 65 years old. Well over one in three residents of Germany could potentially come into an inheritance. Many buyers of holiday properties finance these with money inherited.

Must-Haves: Parking Spot, Balcony and TV Set

The Baltic seaboard ranks high in the favour of potential holiday home buyers. Nearly two in three buyers who already acquired holiday homes opted for flats, while one third chose holiday cottages. Important selling or letting criteria include the availability of car parking. Another must-have feature is a balcony or patio. Balconies overlooking the waterfront justify purchase price mark-ups of at least 25 %. Premium properties in first line to the waterfront and direct proximity to the beach are therefore much more valuable than properties set back from the shore. Four out of five German vacationers want to watch TV even when on holiday and will soon expect free WiFi as another standard feature.

Buyers Attach Increasing Importance on Profits and Appreciation

The majority of holiday properties are acquired as part of a pension plan or as buy-to-let investments. More than three out of four buyers (78.2 %) plan from the start to let the properties they are about to buy, according to a poll by the FeWo-Direkt holiday home letting portal and by the Engel & Völkers estate agency. Half of all owners intend to recover the running costs by doing so, not least because virtually all buyers borrow some of the capital required. The equity capital stake generally runs between 30 % and 50 %. The idea to turn a profit and ensure appreciation is much more common than it used to be a few years back.

The potential temporary owner-occupancy of a holiday property is another peculiarity and simultaneously the second-most important reason for buying one. Accordingly, the distance between the primary place of residence and the location of the holiday home plays a key role. With this in mind, it is easy to see why buyers from the Berlin and Hamburg metro areas set the scene on the Baltic seaboard of Mecklenburg-West Pomerania. The poll by FeWo-Direkt and Engel & Völkers determined average rent revenues of c. 15,000 euros annually before costs, taxes and financing. Based on the average selling price of nearly 420,000 euros that was paid on the Baltic Sea islands between 2011 and 2016, gross returns of around 6 % annually seem realistic.

As a result of strong demand, selling prices have soared over the past years. Average prices rose at around 48 % to a current level of c. 4,600 euros/sqm since 2012. The mean annual growth rate was around 6.8 %. This has pushed return expectations down to a level of 4 % to 5 % lately, depending on the quality of location and property.

Conclusion: From bulwiengesa’s point of view, the demand for new-build holiday properties is likely to persist in the years ahead, while robust tourism performance indicators will drive further price growth. Investments in holiday real estate therefore encouraged by great market opportunities.

Contact person: André Adami, Head of Division Residential for North, West and East Germany at bulwiengesa, adami [at] bulwiengesa.de