Real Estate Prices Have been Rising for the Past 15 Years

Real Estate Prices Have been Rising for the Past 15 Years

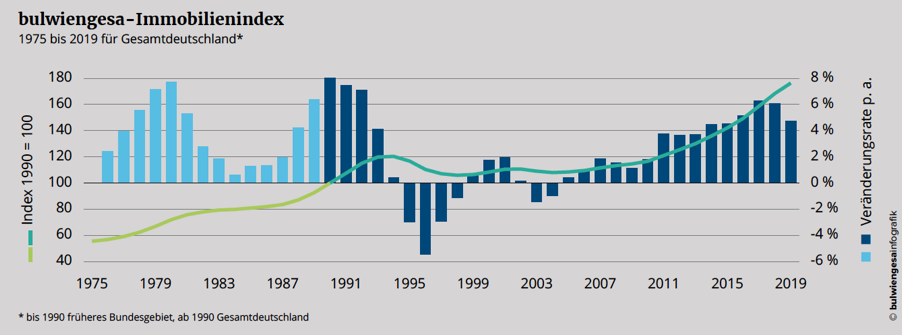

The 44th bulwiengesa Property Index shows: The growth of German real estate prices slowed slightly to 4.7 percent. But there is no reason to speak of an actual downturn. The office market is positively booming while prices for plots zoned for residential and commercial development have soared. Below you will find the five main takeaways from this year’s index.

By the end of 2019, the bulwiengesa Property Index recorded its 15th year of uninterrupted growth. That being said, the growth appears to have peaked as the index for 2020 has fallen behind the growth rates of the past three years.

- Comprehensive index (across segments): 4.7 percent

- “Residential” sub-index: 5.5 percent

- “Commercial” sub-index: 3.2 percent

Residential: Buying Is More Expensive now than Renting

Prices on the housing market have kept surging at +5.5 percent (previous year: +7.0 percent). The leading price drivers are available-for-sale properties, no matter whether you take land prices for single-family detached homes, prices for attached houses or prices for newly-built condominiums. By contrast, rental growth is relatively moderate, both for flats in new (+3.6 percent) and in existing buildings (+2.5 percent).

At the moment, the German housing market is dominated by two main causes for the short supply: a shortage of land and a construction capacity crunch. The Federal Statistical Office (Destatis) reported a modest climb in the number of planning consents, while the building industry indicated an increase in orders on hand for 2020. This would seem to imply a nominal increase in the number of completions. However, a current bottleneck in construction capacities has created a growing construction backlog over the past years.

Conclusion #1: There is still no sign of a rapid expansion of the housing supply through new-build construction that would be typical of an emergent bubble. Interestingly, the expansion of the housing supply is one of the stated political objectives. But even if the building activity was massively expanded – the persistently low level of interest would prevent widespread overheating.

Commercial: No End to the Office Boom

The market for commercial real estate remains indifferent. While retail rents are under pressure, commercial-zoned land and office accommodation are very much in demand. Germany’s office market has registered high take-up levels for several years now. Since office construction has failed to increase in proportion, vacancies are down to half of what they were in 2013.

Office rents have surged since 2010, and grew by 6.0 percent in 2019. Demand for office space in A- and B-Class markets is extremely high. Even some Class C markets—and indeed Class D markets—have benefited from the office market boom. Generally speaking, however, the office sector is a phenomenon limited to the economic centres.

Conclusion #2: Germany’s economic motor has started sputtering a bit, but the domestic economy remains robust. While rents in the major cities are driven by scarcity (both in land and assets), rents in small towns are going up mainly because of construction cost hikes and elevated fit-out standards.

Plots of Land: Price Hikes Hampering New Projects

Another main driver of the robust commercial property index is the growth in land prices at a rate of 6.8 percent. Taking a look at land prices both for residential and commercial properties is extremely important in the urban planning and property development contexts. No other type out of the total of nine index-relevant categories registered a price growth rate as steep as the one for plots. Since 1990, prices for plots with planning consents for detached homes have increased by 137 percent in German cities, and thus more than doubled. The price growth for commercial-zoned land, while not quite as rapid, averaged a brisk 68 percent over the same period of time. In either sector, residential and commercial, land prices registered the steepest growth.

Conclusion #3: The factor is currently one of the key obstacles standing in the way of new quarters and new projects. Sadly, just trading plots of land continues to be more lucrative and less risky in Germany’s cities than their development with flats or offices.

Retail sector: Accelerating Downtrend

A closer look at the retail segment shows: The downtrend that began the previous year has accelerated. The -0.3 percent softening of average retail rents in prime high-street pitches turned into a substantial drop of -1.4 percent. Rental growth in half of the analysed locations has now slipped into the negative range.

Conclusion #4: The uncertainties regarding the expansion policies of many retail multiples and the growing share of e-commerce have an enormous impact on the price trend. Especially in smaller cities of underperforming regions it will be up to the body politic to stabilise the footfall in central high-street locations. On the bright side, district locations which are primarily defined by non-discretionary demand remain interesting to investors.

Outlook: Market Corrections Unlikely

The manufacturing industry is struggling and has somewhat hampered the 2019 business cycle. But despite the modest drop in employment figures in the secondary sector caused by it, the German labour market remains stable. Brisk income growth, tax relief and rising standard wages will probably suffice to offset potential property price hikes for home buyers. It looks as if mortgage interest were likely to bottom out in 2020, which will leave little margin for further price growth on the real estate market.

Conclusion #5: Although one cannot rule out price spikes in some places at this time, major market adjustments continue to be unlikely due to the stable labour market, a persistently sluggish expansion of the real estate supply, most notably in the cities, and the slim likelihood of rapid interest rate hikes going forward.

About the bulwiengesa Property Index

The bulwiengesa Property Index has analysed the performance of Germany’s real estate market since 1975, initially based on 50 West-German cities, and using an expanded basis of 125 cities across the reunited Germany since 1990. The findings of the bulwiengesa Property Index are based on the extensive data collection of bulwiengesa and on the compilation of location and market analyses in line with its independent surveying practice. The database is supplemented annually with pinpoint empirical surveys, local polls and newspaper analyses, and is published in the RIWIS database. The bulwiengesa Property Index is calculated and updated annually on the basis of these data.

For more details, see our brochure and press releases. To acquire specific evaluations and time series, e.g. on certain cities or asset classes, please get in touch with us.

Contact person: Jan Finke, project manager at bulwiengesa, finke [at] bulwiengesa.de