Scores for 400 Districts and 127 Cities

Scores for 400 Districts and 127 Cities

Together with Bayern LB, the state bank of Bavaria, we developed the Deutscher Immobilien Score (DISco). It records present and future strengths/weaknesses profiles of all German real estate markets in the segments office, residential and retail. So, if a small town like Miesbach suddenly outperforms a large Class B city, there are verifiable reasons for it.

The scores appraise the quality and market development of a given city. They give investors, financiers, property developers or fund managers the possibility to see the strengths and weaknesses of a given market at a glance, thereby enabling them to review potential by asset class, region, development over time, and to do so either collectively or as drilldown for specific locational factors and thus with much more precision.

For it needs to be remembered that Germany’s real estate markets are so heterogeneous that even professionals sometimes find it hard to say for sure how much potential a given city has or how stable the risk components of a given location are. By contrast, the time series comparison of the DISco system provides a detailed view of any changes. In what ways has the economy changed on the macro level as well as on each market?

We used six categories to assess the cities:

- Property market

- Accessibility

- Population

- Supply and demand

- Economy

- Financial market

For the first time, the relations between market factors and property prices were determined with this degree of precision and entered into a market scoring. All of the variables taken into account influence their segment scores (yield rates/prices). This way, DISco provides an optimal basis for calculating scenarios.

There are no manual interventions in the weighting of variables: The econometric process we use steers clear of the often-criticised problem of weighting the variables of a scoring models purely according to subjective criteria – with us, both opportunities and risks are captured in a neutral approach. The data sources used include our proprietary RIWIS database, macro-data and forecasts obtained from BayernLB Research, and official statistics.

Scores and Forecasts for 400 Districts and 127 Cities

This basis is used to calculate an annual score for more than 400 districts or independent cities (residential) and for the 127 market cities (office and retail). The start of the time series used for this purpose is 2007 for all segments. The same data is moreover used to calculate forecast scores for the next three years. Our annual housing market forecast, for instance, is also exploited for the scoring model. In addition, we calculate other important forecasts for the real estate market that also enter into the scoring model, among them forecasts on building completions, planning consents, household figures and demographics. The forecasts for the economic parameters are compiled in collaboration with the BayernLB state bank. The DISco scores, by the way, are available in the RIWIS database (riwis [at] bulwiengesa.de).

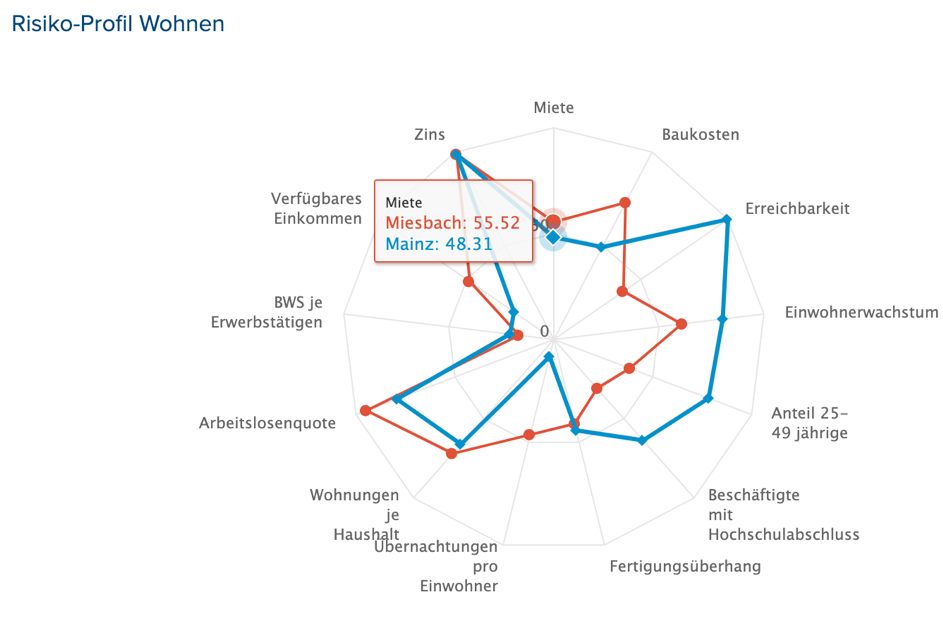

Residential: Miesbach or Mainz?

But back to Miesbach: In what sense does this district capital in Upper Bavaria outperform a major city like Mainz in the residential segment while also being less exposed? As the spider chart shows: Miesbach benefits from a (yet) lower unemployment rate than Mainz, construction costs are lower, the disposable income is higher, and the Bavarian town also boasts more overnight night stays than the state capital of Rhineland-Palatinate.

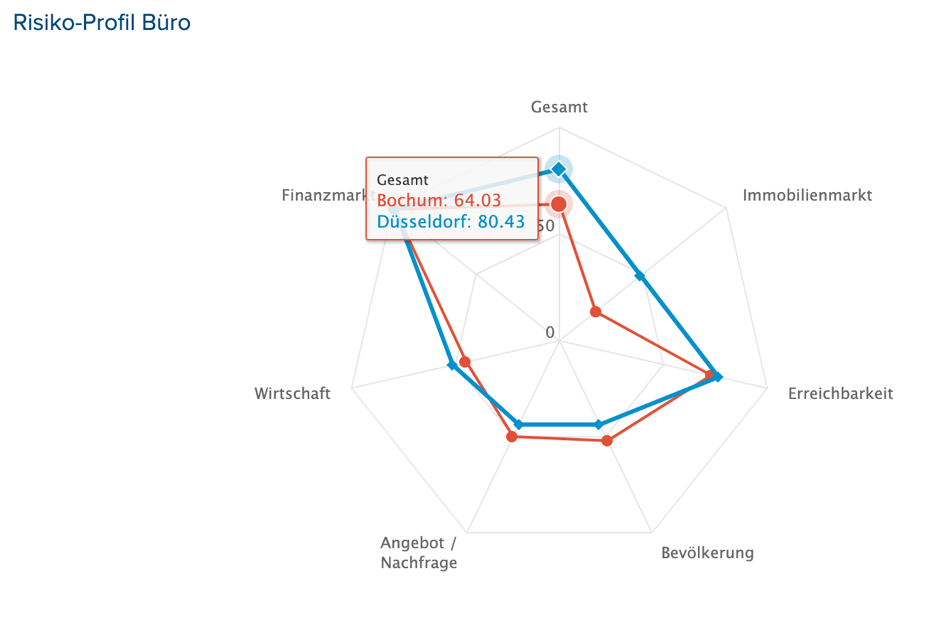

Office: Bochum or Düsseldorf?

Another spider chart shows anyone interested another option for comparisons. In this case, the office segment of two – unequal – cities were matched in a general comparison.

Would you like to test RIWIS or have you got questions? If so, let us know by writing us a note!

Contact person: Björn Bordscheck, Head of Division Data Services at bulwiengesa, bordscheck [at] bulwiengesa.de